[ad_1]

- LTC’s Open Curiosity fell by 9% within the final week.

- Regardless, traders remained bullish.

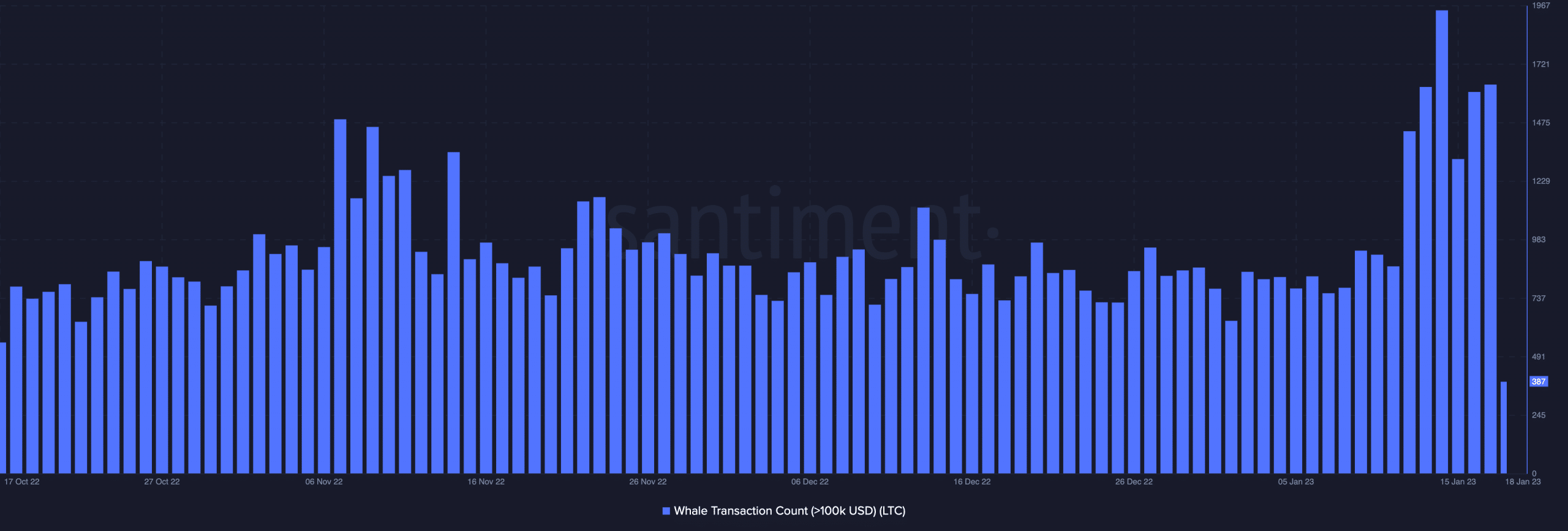

Regardless of the rally within the depend of Litecoin [LTC] transactions above $100,000 for the reason that 12 months started, the regular fall within the alt’s Open Curiosity within the final week indicated that bearish sentiment was returning to the market.

Learn Litecoin’s [LTC] Price Prediction 2023-24

In accordance with information from on-chain analytics platform Santiment, the depend of LTC transactions above $100,000 executed for the reason that graduation of the 2023 buying and selling 12 months has elevated by 75%.

Sharing a statistically vital constructive correlation with main coin Bitcoin [BTC], LTC’s worth went up by 23% since 1 January, information from CoinMarketCap revealed.

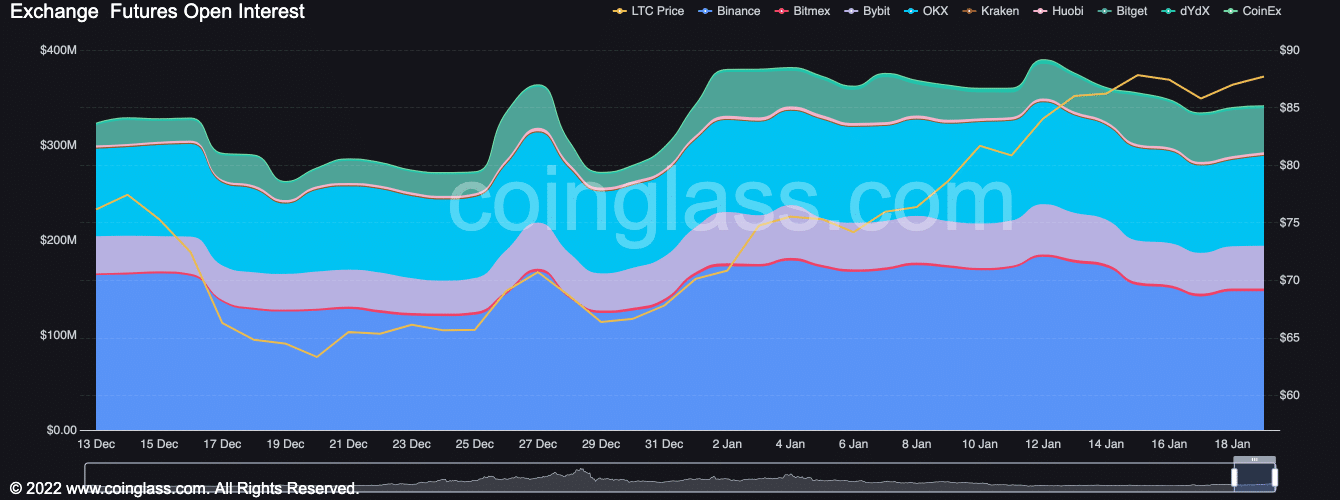

Between 1 January and 12 January, LTC’s Open Curiosity rose by 8%. When the Open Curiosity for crypto belongings will increase, it signifies that extra individuals are getting into into contracts or positions to purchase or promote the cryptocurrency. This may point out elevated buying and selling exercise and market curiosity within the cryptocurrency.

Nevertheless, within the final week, LTC’s Open Curiosity launched into a decline to be pegged on the stage it closed at 2022 as of this writing. In accordance with Coinglass, LTC’s Open Curiosity stood at $341.27 million.

Holders are rooting for Litecoin

Regardless of a gradual decline in LTC’s Open Curiosity, a couple of on-chain metrics recommended that bullish conviction nonetheless lingered within the LTC market.

In accordance with information from Santiment, LTC’s funding charges on main cryptocurrency exchanges Binance and DyDx have been constructive within the final week.

A crypto asset logs constructive funding charges when the rate of interest paid to these holding brief positions within the asset is larger than the rate of interest earned by these holding lengthy positions.

This occurs when demand is excessive. A constructive funding fee signifies the market is optimistic in regards to the cryptocurrency’s potential and continued worth progress.

Additional, LTC’s weighted sentiment has been considerably constructive for the reason that 12 months began, information from Santiment confirmed. To date this 12 months, at any time when market sentiment turned unfavourable, it was rapidly changed by constructive investor sentiment, indicating that bullish conviction exceeded bearish conviction. At press time, LTC’s weighted sentiment stood at 0.79.

Life like or not, right here’s LTCs market cap in BTC’s terms

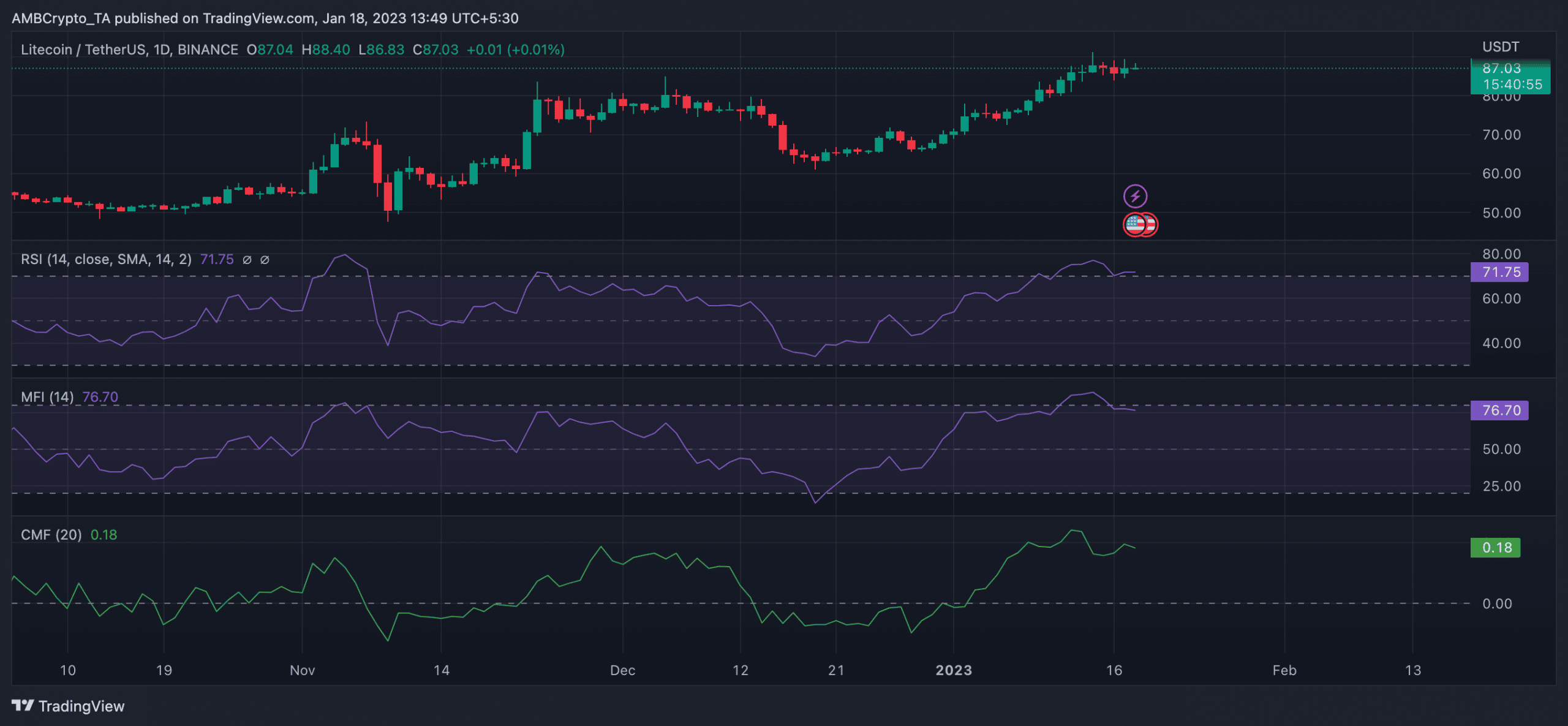

Actions on the worth chart revealed that purchasing momentum remained sturdy. Oversold at press time, the alt’s Relative Energy Index (RSI) laid at 71.75. Equally, its Cash Stream Index (MFI) was noticed at 76.70.

Lastly, the dynamic line (inexperienced) of LTC’s Chaikin Cash Stream (CMF) was positioned removed from its heart line within the constructive zone. At press time, the CMF was 0.19. When an asset’s CMF indicator is constructive, it suggests that cash is flowing into the asset, indicating bullish sentiment and an uptrend out there.

[ad_2]

Source link

![Litecoin [LTC]: A decline in Open Interest does not mean that buyers are done](https://crypto-newsflash.com/wp-content/uploads/2023/01/1672374537870-62b817f9-f6a7-49e4-a669-006b119a515e-1000x600-750x375.jpg)