[ad_1]

- Bitcoin investor urge for food has resumed, in keeping with a number of indicators.

- Nevertheless, there’s nonetheless a threat for BTC’s draw back.

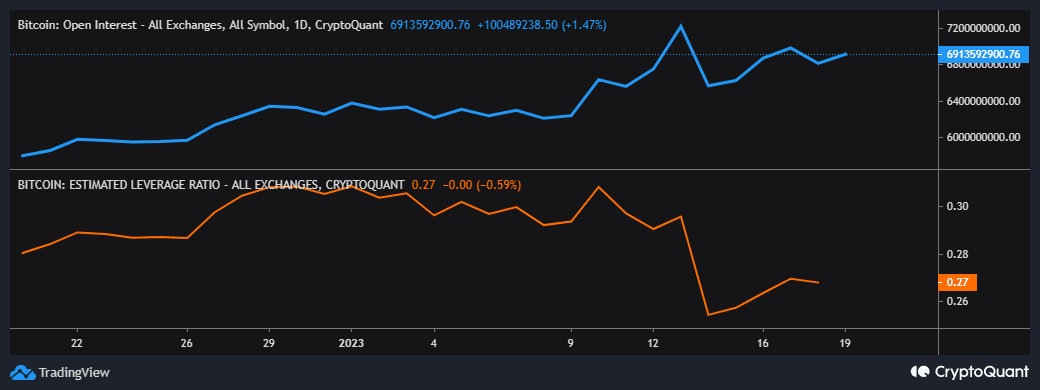

As per a CryptoQuant analysis on 19 January, a number of alerts have been figuring out the beginning of Bitcoin’s [BTC] subsequent bull run at press time. One of many largest observations was that BTC’s holders shifted their cash from the spot to the derivatives market, because it allowed them to faucet into leverage.

Is your portfolio inexperienced? Take a look at the Bitcoin Profit Calculator

The Shift onto the derivatives market was confirmed by the rise in Open Interest for the reason that begin of the yr. Nevertheless, the estimated leverage ratio dropped off within the first half of the month and was solely beginning to rally at press time. This was seemingly as a result of many leveraged positions have been liquidated within the first two weeks.

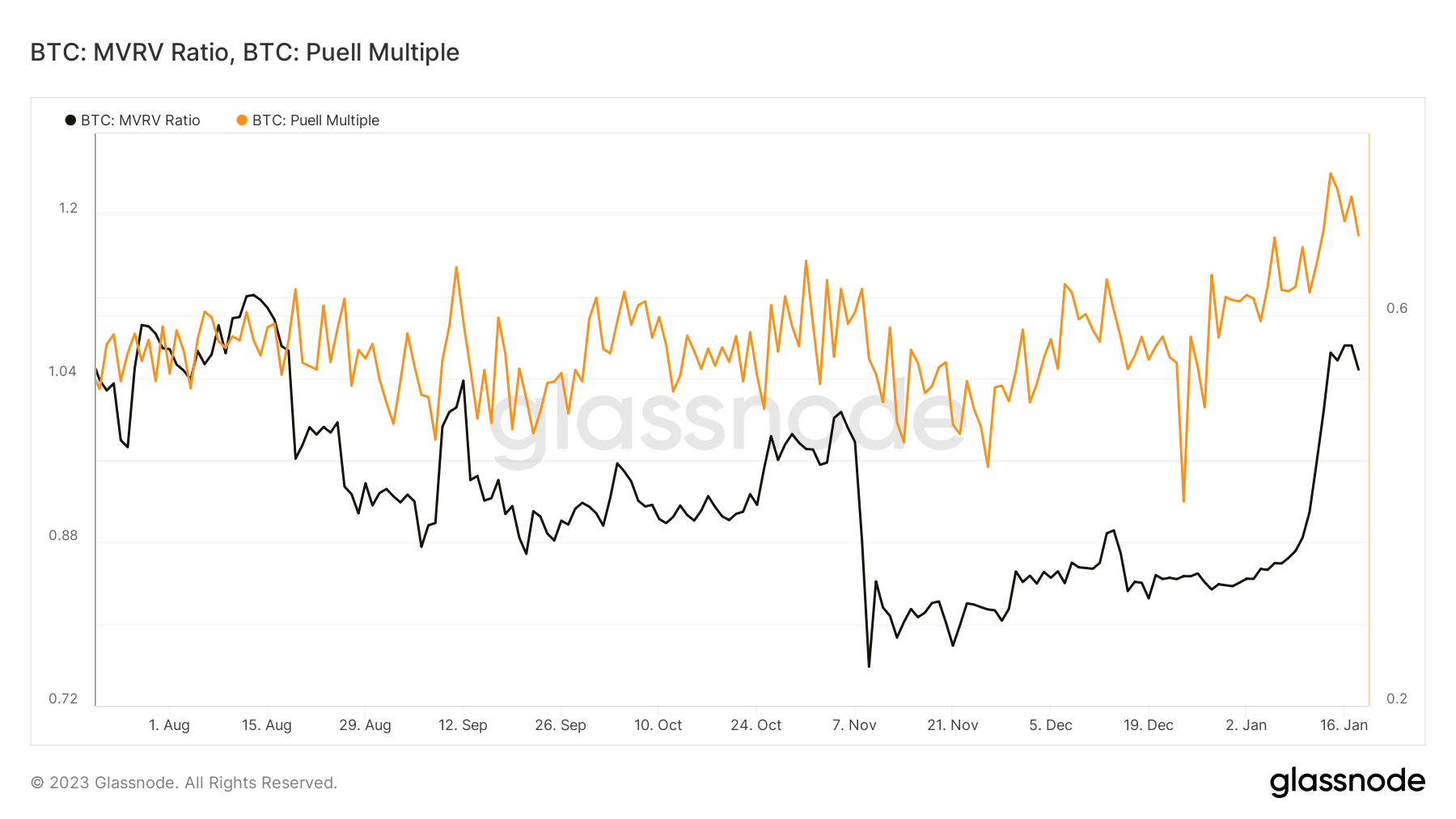

The CryptoQuant evaluation additionally seemed into the MVRV ratio to determine the beginning of a brand new uptrend. In keeping with the evaluation, Bitcoin’s MVRV ratio was at present trying to get well above 1. The Puell a number of demonstrated an analogous statement with a shift in favor of the constructive development.

Is Bitcoin susceptible to one other crash?

Nevertheless, there was nonetheless a big threat of potential draw back at press time. One explicit main threat was hooked up to the Digital Forex Group (DCG) and Genesis solvency, courtesy of the GBTC mismanagement. A possible mega liquidation related to this threat might set off one other main selloff, probably eroding BTC’s newest positive factors.

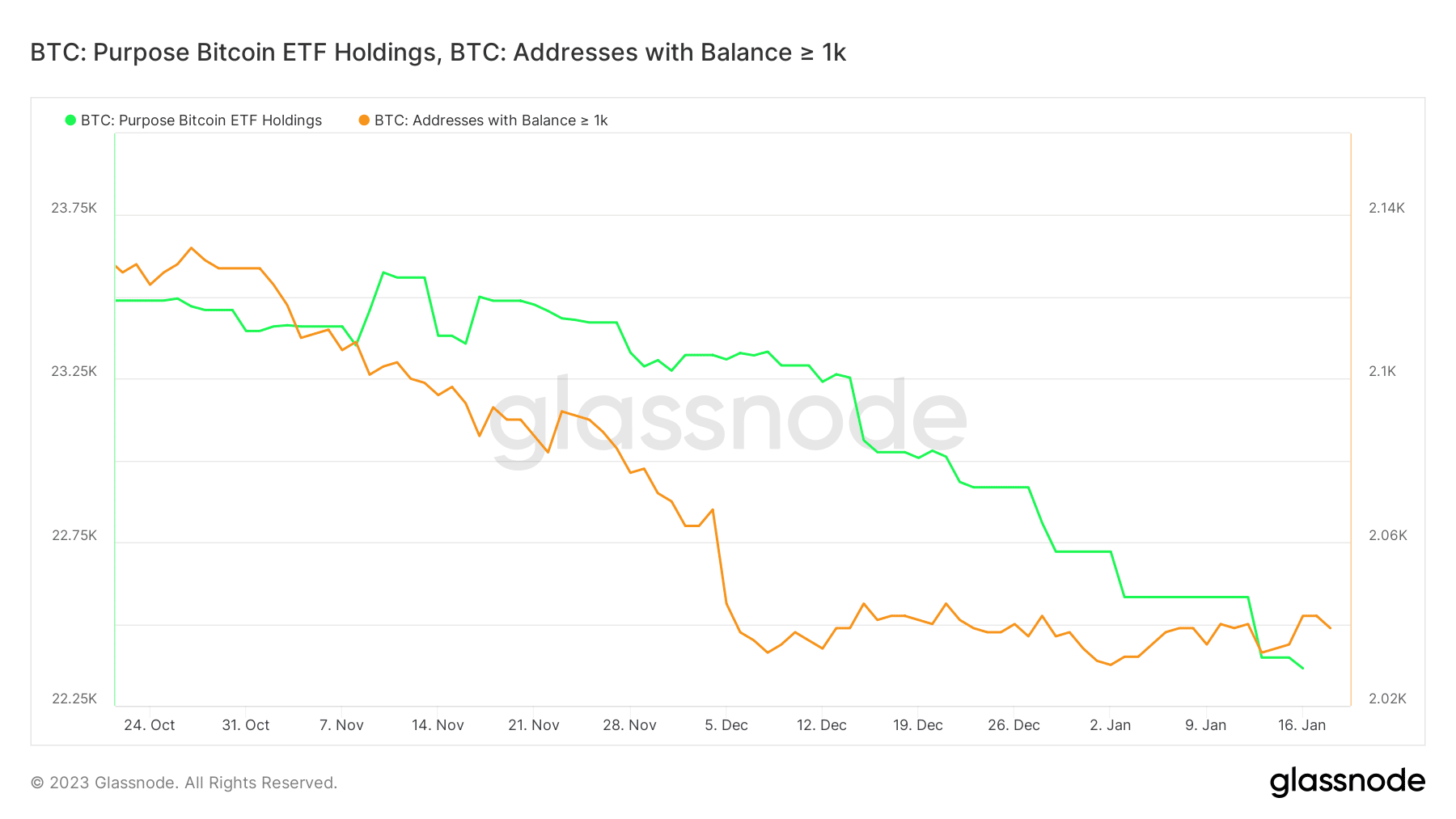

The above threat may be the rationale why the Function Bitcoin ETF holdings has continued to dump its BTC. Equally, the variety of addresses holding over 1,000 BTC solely elevated by a small margin for the reason that begin of January 2023.

How a lot are 1,10,100 Bitcoins worth today?

These observations revealed that there have been market individuals that weren’t but prepared to leap again into the market at press time. This was probably as a result of aforementioned dangers. However, the rally within the first half of January was largely propagated by whales.

GBTC’s threat continued to be an active threat to bulls on the time of writing. Nevertheless, there was nonetheless an opportunity that the market could overcome this threat. Nonetheless, savvy traders ought to preserve a detailed eye on DCG and Genesis as a result of the developments could decide the eventual consequence.

[ad_2]

Source link

![Bitcoin [BTC] investors embrace risk-on approach, but beware of hidden risks](https://crypto-newsflash.com/wp-content/uploads/2023/01/1672489355757-2cedd20c-4515-4892-adc9-61c7fd88f695-1-1000x600-750x375.png)