[ad_1]

cemagraphics/iStock through Getty Photos

On Feb 2023 dYdX will unlock a large quantity of dYdX (DYDX-USD) tokens for buyers and workers, which makes dYdX token a tough cross, a promote, and even possibly a brief candidate in our e book. The provision will double very quickly, on February 2nd. Then by subsequent 12 months it’s going to 5X which is able to dilute the worth of every token much more.

We will not absolutely suggest shorting this token as a result of we do not know with certainty what the buyers and workers will do with their liquid tokens. However, we’ll discover the probabilities and chances on this article and let our readers make up their minds on that doable path. Our base case is a sport concept optimum determination by the collective group of buyers to promote ~50% of their whole token curiosity and preserve the remaining for 10 + years.

dYdX has a number of the worst tokenomics in the entire of crypto. In our six years of crypto, we now have witnessed many tasks implode on account of unhealthy tokenomics all of the whereas being respectable tasks to say the least. On many events we now have used these occasions to make a revenue. dYdX has the second largest inflation in all of crypto and, us being economists, simply cannot combat the apparent provide and demand imbalance and sure worth destruction through dilution or promote strain that’s about to happen.

What’s dYdX?

dYdX is a decentralized alternate, additionally known as a “dex,” that gives perpetual futures contracts on its semi-decentralized alternate, that are corresponding to different centralized exchanges comparable to Binance, or the earlier FTX alternate (R.I.P). Utilizing dYdX, merchants can short-sell tokens, enhance publicity by longing with leverage, or earn curiosity/rewards on deposited tokens. The long run goal of the protocol is to create a totally decentralized derivatives alternate the place nobody individual or entity, not even the event workforce, can have management over the protocol’s core features.

The alternate is called after the differential equation for derivatives notation in calculus “dY/dX” also referred to as Leibniz’s notation. The alternate was based in 2017 and went dwell in 2019. dYdX token’s initial coin offering (ICO) was on September ninth 2021.

dYdX was minted as an ERC-20 token on the Ethereum blockchain together with the preliminary dYdX protocol working on Ethereum. Now, dYdX protocol is operated on the Layer-2 (L2) StarkEx network which has decrease charges and sooner transactions for customers, relative to L1 Ethereum whereas nonetheless benefiting from Ethereum’s safety as all different ETH L2 chains do. However, lately dYdX announced intentions to construct “dYdX V4 as a standalone blockchain primarily based on the Cosmos SDK and Tendermint Proof-of-stake consensus protocol.”

- Facet word: dYdX platform customers may be eligible for StarkEx token airdrop if there ever turns into one, as it’s a main venture with no token and dYdX is the largest platform to make use of StarkEx expertise. However, I digress, away from air-drop hacking my fellow crypto degens.

dYdX token utility and the dearth thereof

The token dYdX has two makes use of as of now. First, it’s a governance token which provides the holder the suitable to take part within the governance of the protocol and the long run modifications and finances allocations. Second use for the token is low cost utility. Token holders get reductions on buying and selling and also can stake their tokens to earn curiosity. Tokens which have some form of utility, will be categorized as utility tokens and have a greater likelihood of passing the “The Howey Test” and never being categorized as securities.

dydx.alternate/

In style false impression is that the dYdX token holders are entitled to revenue sharing from the platform charges much like a shareholder in a standard alternate. As of now, that’s not the case, nor are there any plans to make it so, as this might most certainly make the token be then categorized as a safety in response to the Howey Take a look at, and entangle the alternate which is domiciled in San Francisco, California, in a slew of authorized points a minimum of within the US.

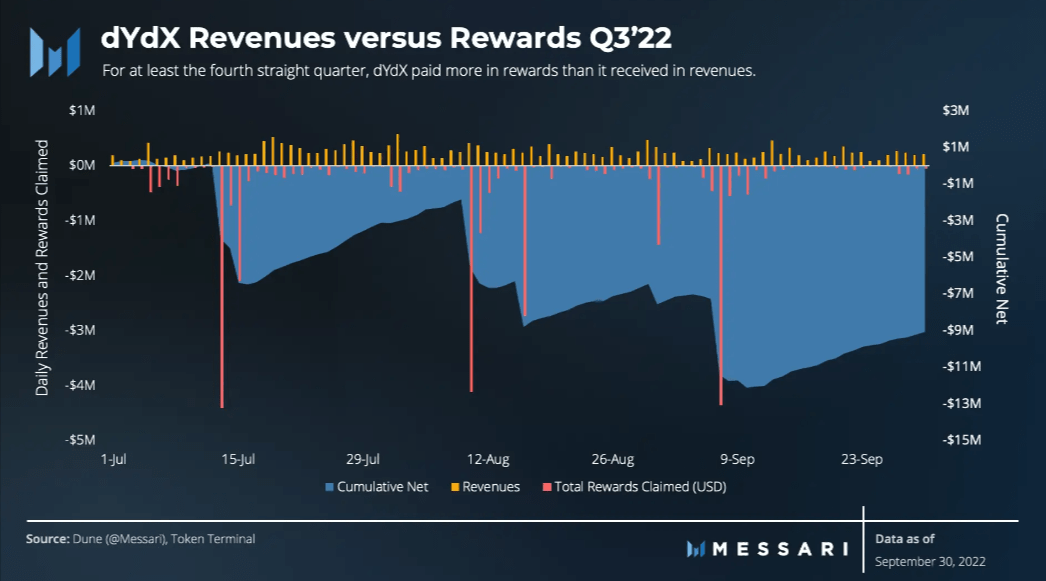

Even when the income was shared with the token holders the alternate is paying out extra in rewards than is making in income. Moreover, the every day common customers depend is only one,650, which does not scream fashionable.

messari.io/report/state-of-dydx-q3-2022

Funding and Token Provide

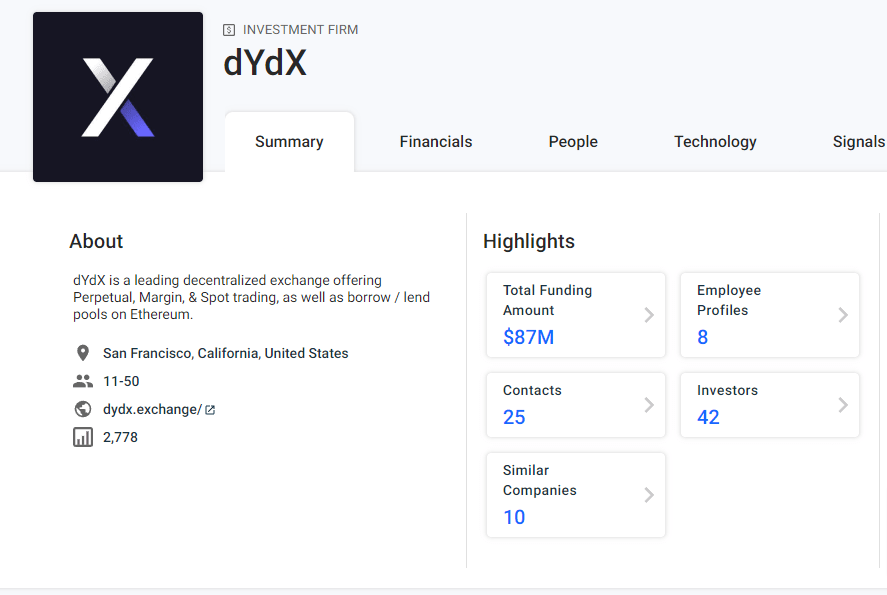

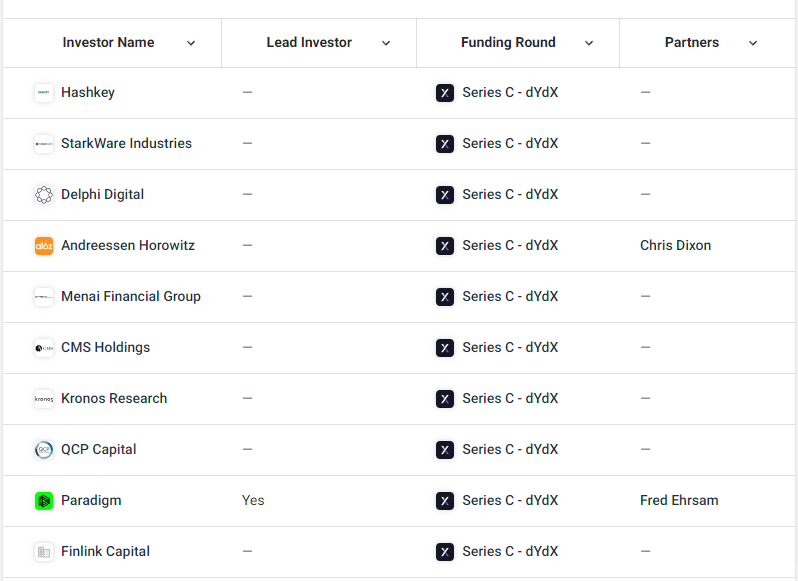

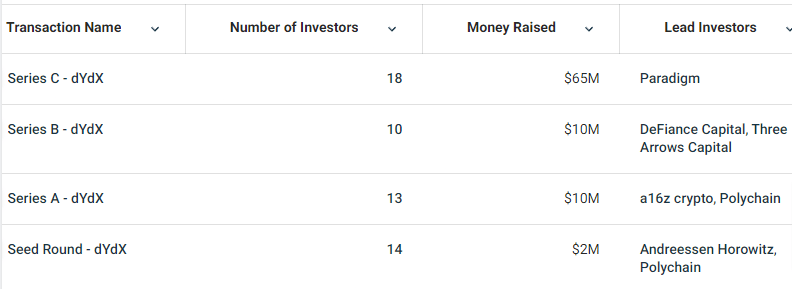

In line with CrunchBase, the overall funding quantity was $87M over 4 funding rounds.

crunchbase.com/group/dydx

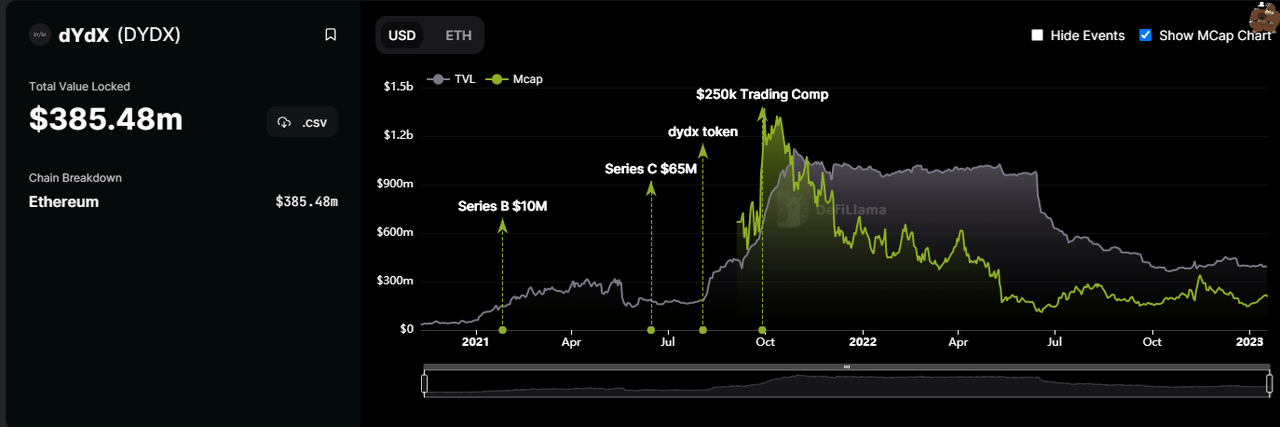

On the DefiLlama chart beneath, we are able to see the market capitalization throughout Collection B &C funding rounds, launch of the dYdX token on August third 2021, in addition to the buying and selling competitors. Present market capitalization sits round $200M, however we are able to see within the chart beneath it has been as excessive as ~$1.3B throughout the top of the 2021 bull market.

defillama.com/protocol/dydx?showMcapChart=true

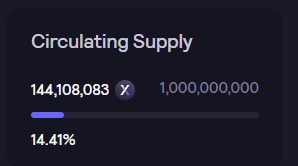

Complete and circulating provide of dYdX token

dydx.group/dashboard

In line with the dYdX website there have been a complete of 1 billion dYdX minted, that are to be distributed over a 5 12 months interval, beginning on August third 2021. Present circulating provide is 144,108,083 in response to the dYdX group dashboard above.

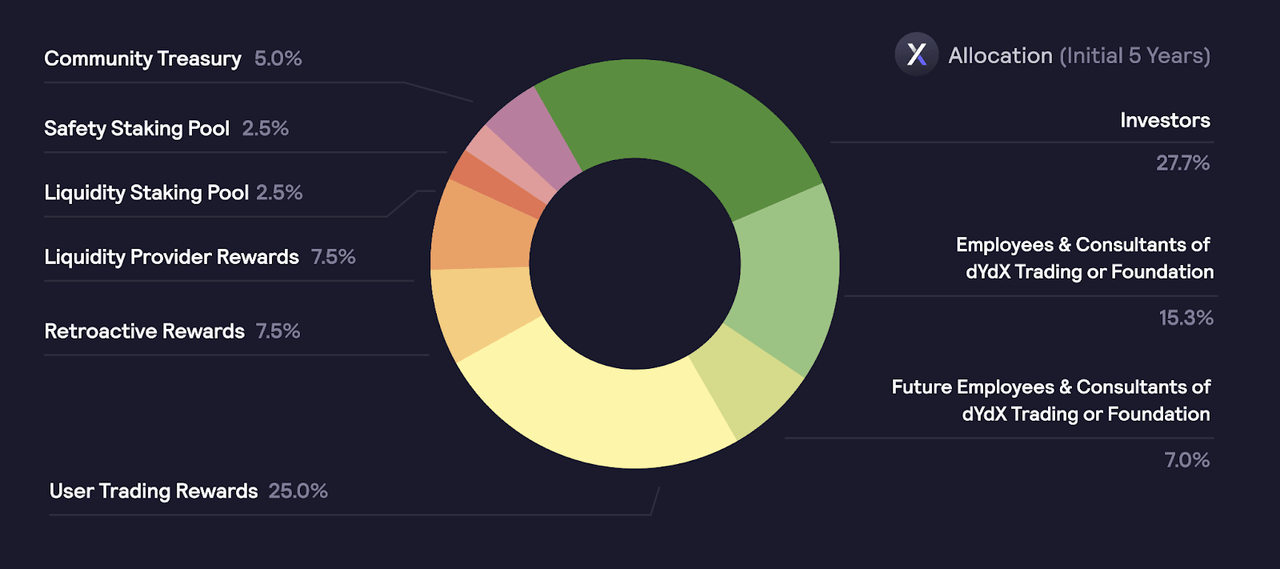

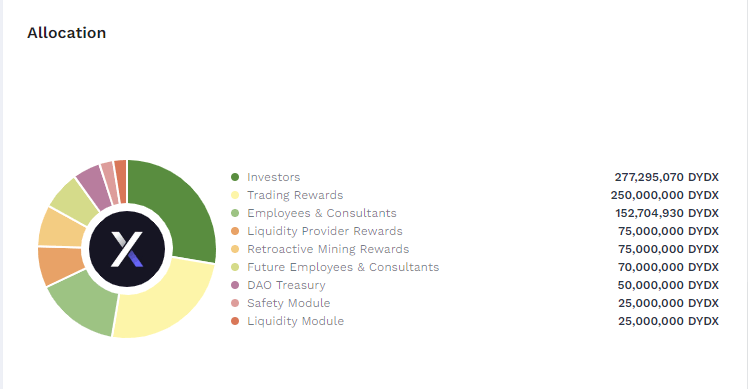

Token allocation breakdown

-

50.00% of the availability will go to the group (500,000,000 DYDX)

-

25.00% might be used as buying and selling rewards (250,000,000 DYDX)

-

7.50% might be put aside for retroactive mining rewards (75,000,000 DYDX)

-

7.50% might be assigned for liquidity supplier rewards (75,000,000 DYDX)

-

5.00% will go to a group treasury (50,000,000 DYDX)

-

2.50% might be devoted to customers staking USDC to a liquidity staking pool (25,000,000 DYDX)

-

2.50% – to customers staking dYdX to a security staking pool (25,000,000 DYDX)

-

27.73% might be put aside for buyers (277,295,070 DYDX)

-

15.27% will go to founders, workers, advisors, and consultants (152,704,930 DYDX)

-

7.00% might be stored for future workers and consultants of dYdX (70,000,000 DYDX)

docs.dydx.group/dydx-governance/start-here/dydx-allocations

Can extra dYdX tokens be minted?

Sure, 5 years after launch, a most inflation charge of two% per 12 months will be applied to provide the group and builders sources to proceed contributing to the dYdX protocol. In 2026 dYdX group can determine through governance vote utilizing their tokens voting energy, what the utmost provide of recent tokens to be minted can be, as much as 2%.

docs.dydx.group/dydx-governance/start-here/dydx-allocations

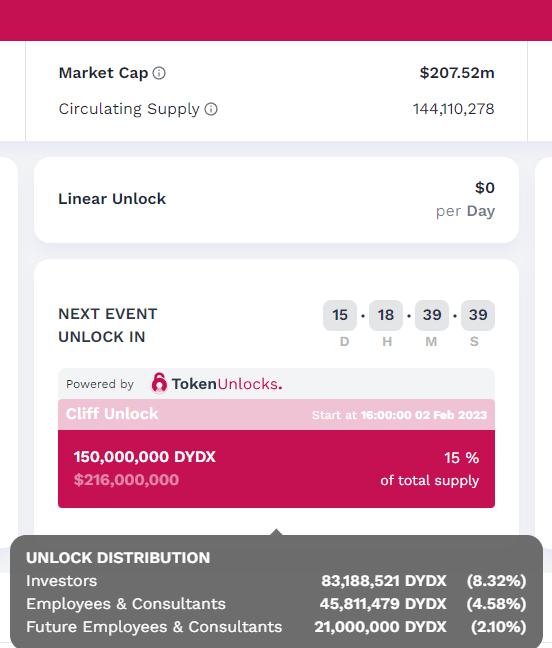

Incoming Liquid Provide Tsunami

February 02 2023, marks a large unlock interval that begins off with a bang and continues so as to add gasoline to the hearth each 30 days.

Unlock dashboard (token.unlocks.app/dydx)

Because of this on Feb 2, 2023, the availability goes from 144,110, 278 plus further 150M to a complete liquid provide of 290,000,000.

And if the present market worth of $207.5M can be divided by the brand new diluted provide of 290M, it might suggest a token worth of ~ $0.70 (207.5/290), which is about 50% decrease than worth of $1.44 on the time of writing.

However wait – there’s extra.

-

Each day buying and selling rewards unlock each month and provides ~3.8 Million tokens of liquid provide

-

1.1 million liquidity supplier rewards as soon as a month

-

Liquidity module : 378,788 every month

-

Security module : 378,788 every month

Month-to-month whole: 5.6 million

And that is not all.

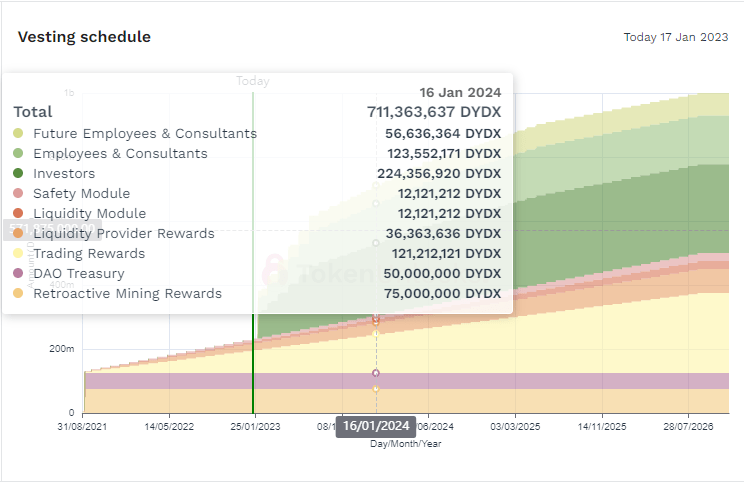

The liquid provide retains growing by ~40M further tokens each 30 days on prime of the 5.6M month-to-month.

So by this time subsequent 12 months on Jan 16, 2024 the overall liquid provide might be 711,363,637.

711,363,637 / 144,108,083 = ~5.

See chart beneath for the unlock cliff coming in February and the inflow of tokens that follows, reaching 1 billion by 2026.

dydx Unlock schedule (token.unlocks.app/dydx)

So over the following 12 months the liquid provide might be 5 X from right this moment. Are you interested by that a lot dilution? As a result of we’re not.

By this time subsequent 12 months the dilution adjusted token worth by right this moment’s market cap. is about $0.3 ($207M/711dYdX= $0.29 dYdX), which coincidentally is concerning the common price buyers paid for his or her tokens.

Sport concept

Game theory arguments recommend that it might be in the most effective curiosity of the buyers to a minimum of recoup their preliminary $87 million, whereas they will. This could suggest a promote strain of about half the unlock quantity. This motion would deliver the chance all the way down to 0 whereas nonetheless permitting them to guess on the long run success of the venture.

Rule #1 of investing is: DON’T LOSE MONEY.

We are going to come again to the rule#1 once we focus on dYdX’s largest investor.

Why buyers may not promote regardless of the incentives

Some buyers will not promote it doesn’t matter what the sport theoretic incentives recommend for just a few causes:

1. Popularity

Institutional popularity – is all the things within the funding world, and if the VC will get a popularity as a fund that simply dumps as quickly as they will, they may shut themselves out of the long run alternatives as they’d be labeled as a foul associate. (Nevertheless, this doesn’t suggest they can not promote a bit bit as a part of their threat administration technique.)

2. Liquidity

Buyers that promote giant quantities, do not use common exchanges like us plebs to transact. They usually discover a purchaser and make the transaction privately off the general public alternate. Public markets in crypto don’t have deep liquidity that institutional buyers require to transact. In the event that they have been to promote a big quantity on the open market, the worth would free fall. And a free fall worth will not be of their curiosity; except, in addition they have a brief leveraged spinoff place.

3. Philosophy

Some buyers have a really strict funding philosophy in early industries and corporations. These buyers usually do not promote for no less than 10 years or typically the maintain length is without end.

This may seem to be a loopy situation to lock your self into however, if we have a look at profitable big tech firms, in virtually each state of affairs holding for 10+ years is the most effective and most worthwhile determination even when 80-90% of the portfolio firms go to zero. The few winners within the portfolio which are Google, Amazon, or Tesla pay for all of the losses and nonetheless give a large revenue to people who held long run. (Nevertheless, this doesn’t suggest they can not promote a bit bit as a part of their threat administration technique.)

Due to the explanations mentioned (Popularity, Liquidity, Philosophy), we’re unsure how buyers will act throughout the unlock, however we suspect that some will take the chance to money out and coloration up. Money out their dYdX tokens at a revenue of 100-500% and purchase presently depressed blue chip cash like ETH and BTC and even Coinbase shares (COIN) within the case of Brian Armstrong the CEO of Coinbase, a noteworthy investor in dYdX.

Long run we nonetheless venture a possible sport theoretic final result because the unlock will proceed for the remainder of 2023 and on. The danger/reward solely will get worse for present holders and those who get the unlock in early February as the availability tends in the direction of 1 billion tokens and quintuples within the subsequent 12 months alone, to over 700M.

Our name is to promote dYdX tokens and never look again. At the very least till you will get in on the VC worth of $0.3 per token.

Why some buyers ought to promote

With their $87M funding the VC buyers secured 27.73% of the overall provide, a whopping 277,295,070 dYdX tokens.

With some excessive degree differential multivariate calculus beneath, we are able to see that their per token common worth comes out to ~ $0.31/dYdX.

Advanced math >> $87,000,000 / 277,295,070 dYdX = ~ $0.31/dYdX

Many of the buyers listed have a private or agency philosophy on taking revenue. Most of them subscribe to a long run funding philosophy as tech buyers ought to. In an effort to adhere to rule #1 of investing and to play with home cash, so to talk, the buyers might want to promote a minimum of $87M in worth to recoup their preliminary funding. dYdX has a who’s who of a crypto buyers checklist. Most notably Andreessen Horowitz (a.okay.a. A16Z), Polychain, Paradigm (the biggest investor at $65M), and sadly additionally the now blown up hedge fund, Three Arrows Capital (a.okay.a. 3AC).

dydx buyers checklist (crunchbase.com/group/dydx/investor_financials)

The noteworthy buyers above are identified for long run holding. A16Z has an insanely spectacular IPO or acquisition exit list.

3AC is now bankrupt, so their dYdX property will most certainly be liquidated to pay collectors. 3AC provides us one pressured promoting domino within the promote strain that will manifest as soon as the tokens are unlocked.

4 rounds of buyers (crunchbase.com/group/dydx/investor_financials)

Matt Huang, a co-founder of Paradigm, said on twitter that the enterprise capital firm wrote down its whole stake within the collapsed FTX alternate. A complete of $290 million was invested by Paradigm in a set of firms run by former FTX CEO, Sam Bankman-Fried. As the largest investor in dYdX Paradigm may want to seek out some liquidity through their dYdX token unlock, with the intention to clear the pie off their face from the FTX debacle. Subsequently, we’ll assign a non-zero chance that they may promote some and possibly numerous their dYdX tokens as soon as they unlock.

Will workers promote?

Not like buyers who could have a long run funding philosophy or reputations to keep up, the workers aren’t held to an analogous normal. We imagine it’s a prudent monetary determination to diversify one’s wealth from a single supply. The worker’s present revenue/wage is dYdX dependent, their future investments shouldn’t be additionally depending on dYdX. There are various threat components in each investing in, and work for, a crypto venture. It might be prudent threat mitigation to have a diversified portfolio of crypto or different property, so we’ll assume that a minimum of some workers perceive the chance and are going to behave rationally with the data of incoming inflation to money out a few of their threat.

Closing phrases

Will the unlocked tokens hit the open market and add promote strain? We do not know for certain how the workers and buyers will act with their unlocked tokens, however the threat is simply too excessive to guess in opposition to human nature and sport concept, so that’s the reason we now have liquidated our dYdX place in 2022 and don’t plan so as to add any in 2023.

Totally diluted token worth after the massive February unlock is $0.70, which is 50% decrease than right this moment’s worth, and offers us a good margin of error even when the buyers have diamond palms, that the market will reprice the token primarily based on market capitalization dilution alone.

Some buyers have gone bankrupt like 3AC and their tokens may hit the market as collectors get what they’re owed; which may be one and solely domino wanted to kick off the run for the exit. The largest investor has taken an enormous hit currently and may be a motivated vendor if the LPs begin asking powerful questions on their lack of due diligence with the current FTX catastrophe.

We strongly imagine that the chance of holding or shopping for dYdX tokens is simply too excessive given the dilution and lack of utility or worth the token represents presently. If and when dYdX is ready to share alternate income with the token holders we might be prepared to think about investing, however till that point, we don’t see the worth on this governance/low cost token to justify the doubling of the market capitalization with abhorrent tokenomics.

Lastly, there’s a giant brief elephant within the room. Any one of many buyers or workers might open a brief leveraged spinoff place and dump their newly unlocked tokens on the open market to make a large revenue on their spinoff place. One thing like this may not fly in conventional markets, however in crypto this form of manipulation is not far-fetched, nor unlawful.

[ad_2]

Source link