[ad_1]

TL;DR Breakdown

- Polkadot worth evaluation suggests upwards motion to the $6.60 resistance once more

- The closest assist degree lies at $6.400

- DOT faces resistance on the $6.727 mark

The Polkadot worth evaluation reveals that the DOT worth motion has fallen under the $6.500 degree, however the bulls discover short-term assist at $6.400 mark.

The broader cryptocurrency market noticed a bearish market sentiment over the past 24 hours as most main cryptocurrencies recorded unfavourable worth actions. Main gamers embody NEAR and AVAX, recording a 6.97, and a 6.09 % decline, respectively.

Polkadot worth evaluation: DOT falls under $6.500

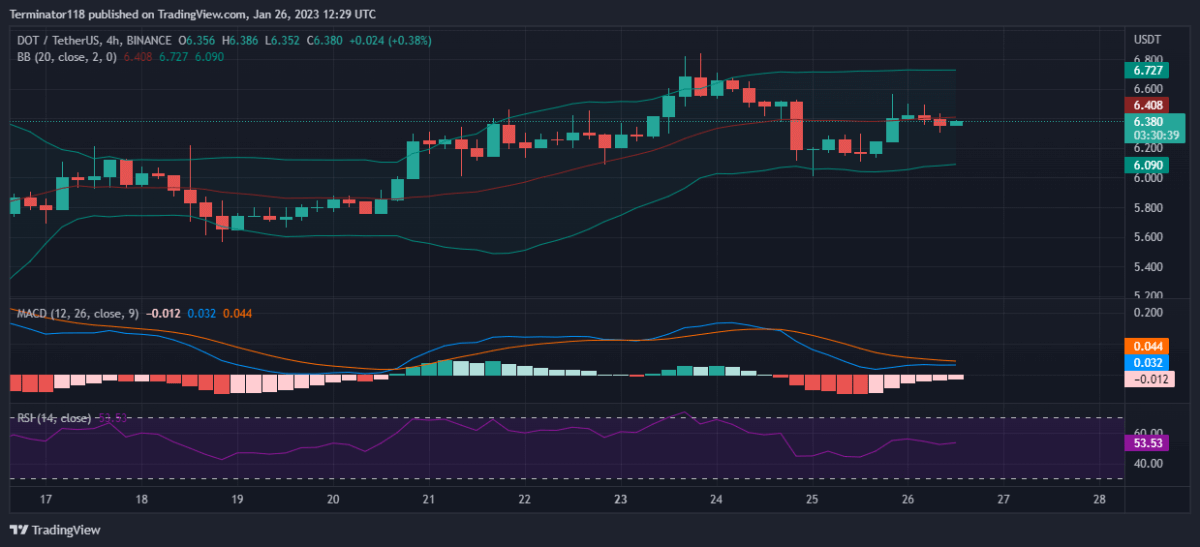

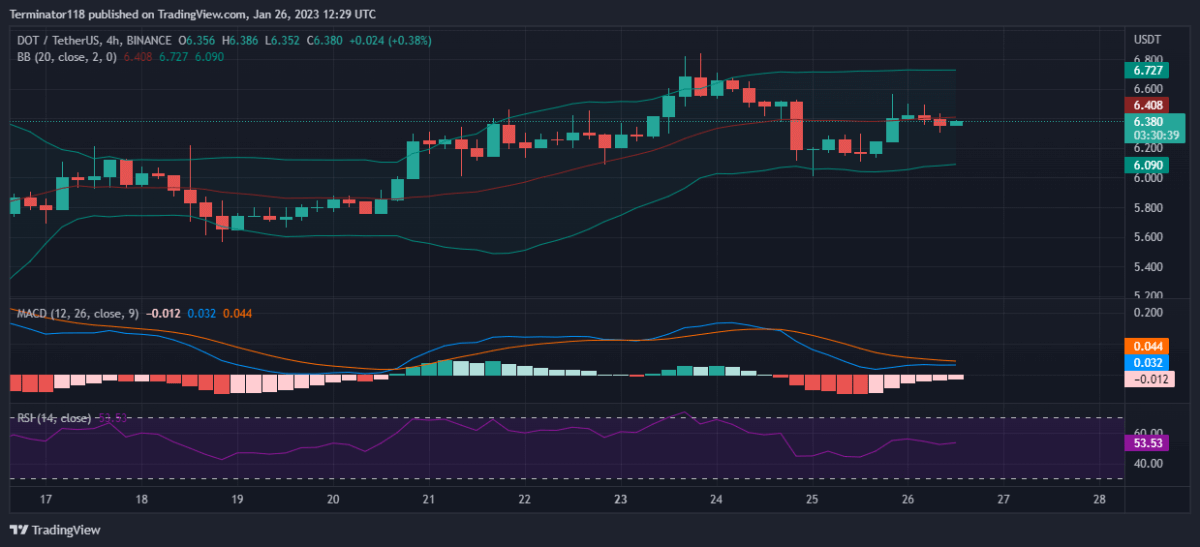

The MACD is at the moment bearish, as expressed within the purple color of the histogram. Nonetheless, the indicator reveals low bearish momentum as expressed within the brief depth of the indicator. Furthermore, the lighter shade of the histogram reveals a declining bearish stress as the worth finds assist on the $6.400 mark.

The EMAs are at the moment buying and selling above the imply place as internet worth motion over the past ten days stays constructive. At present, the EMAs are buying and selling shut to one another exhibiting low momentum at press time. Furthermore, the converging EMAs recommend a reducing bearish stress for the asset.

The RSI briefly rose to the overbought area however has since gone down towards the imply line because the bullish momentum slowed down. At press time, the indicator has retreated to the imply line on the 53.53 index unit degree exhibiting low internet momentum. Furthermore, the horizontal worth motion reveals low exercise within the markets in current hours.

The Bollinger Bands are at the moment slim as the worth motion reveals low volatility in current days. Nonetheless, the indicator is converging as the worth motion observes low volatility close to the imply line of the indicator. The indicator’s backside line gives assist on the $6.090 mark whereas the underside line presents a resistance degree on the $6.727 mark.

Technical analyses for DOT/USDT

Total, the 4-hour Polkadot price evaluation points a purchase sign, with 12 of the 26 main technical indicators supporting the bulls. Alternatively, 4 of the indications assist the bears exhibiting low bearish presence in current hours. On the similar time, 9 indicators sit on the fence and assist neither facet of the market.

The 24-hour Polkadot worth evaluation doesn’t share this sentiment and as a substitute points a purchase sign with 14 indicators suggesting an upwards motion in opposition to 4 suggesting a downward motion. The evaluation reveals robust bullish dominance throughout the mid-term charts with little bearish resistance persisting. In the meantime, the remaining ten indicators stay impartial and don’t challenge any alerts at press time.

What to anticipate from Polkadot worth evaluation?

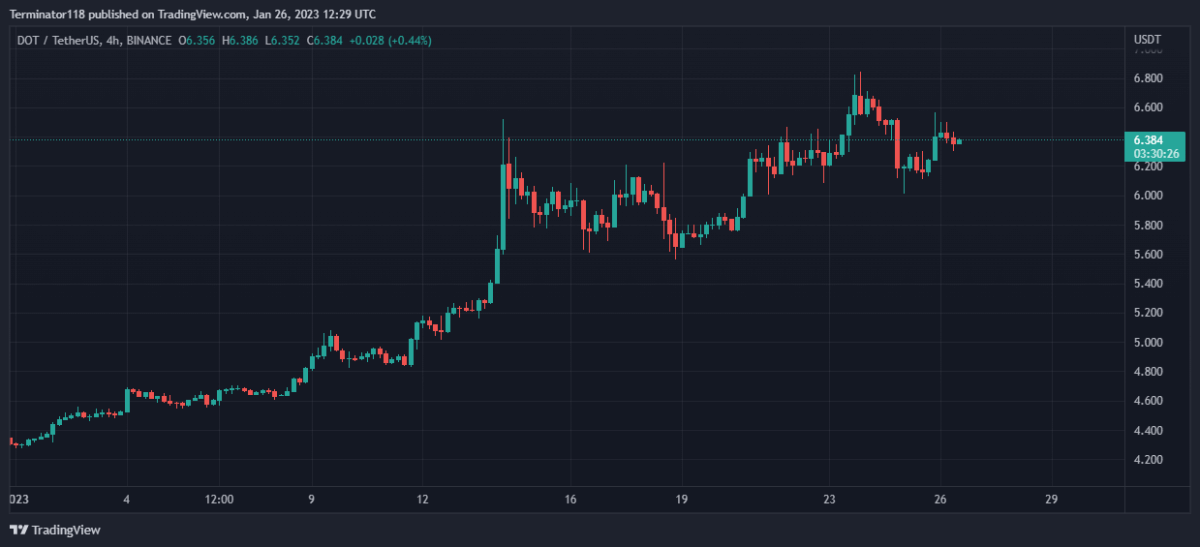

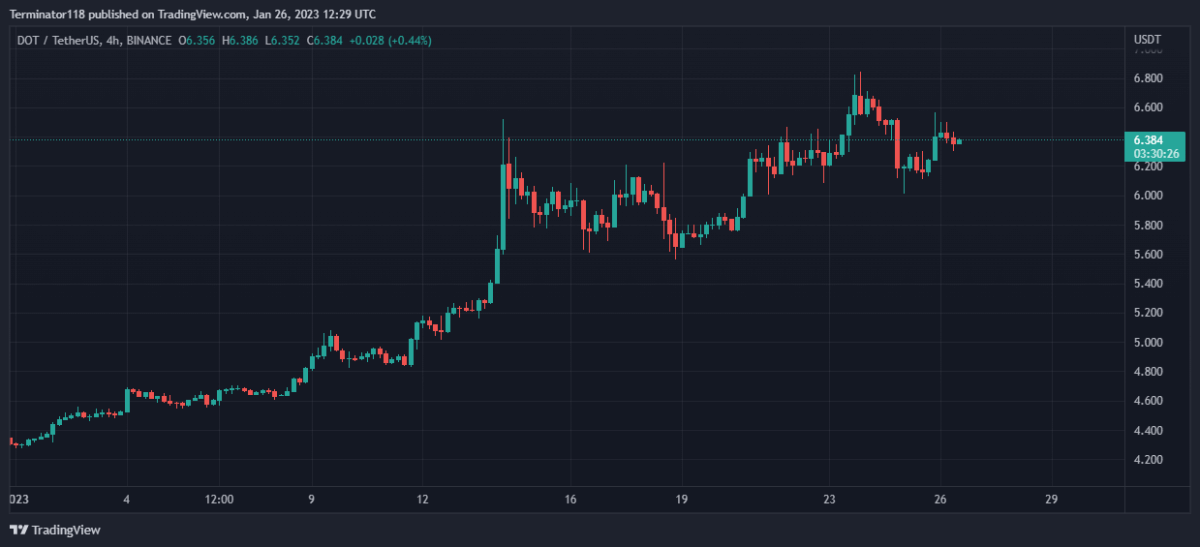

The Polkadot worth evaluation reveals that the Polkadot market is having fun with a powerful bullish rally as the worth rose from $4.300 to the present $6.500 within the final 30 days. At present, the worth is going through robust bearish stress at this degree as the worth motion was rejected on the $6.800 mark and falls again towards the $6.400 mark.

Merchants ought to anticipate DOT to seek out robust assist on the $6.400 mark because the bearish stress subsides. Whereas the short-term technicals are bearish, they present a declining bearish momentum because the bulls take again the reins. The suggestion is strengthened by the bullish mid-term analyses, that recommend upwards motion to the $6.80 mark because the bulls make one other try to climb to the $7.00 degree.

[ad_2]

Source link