[ad_1]

- Rising gasoline costs might have an effect on Ethereum.

- NFT trades decline, however merchants present optimism.

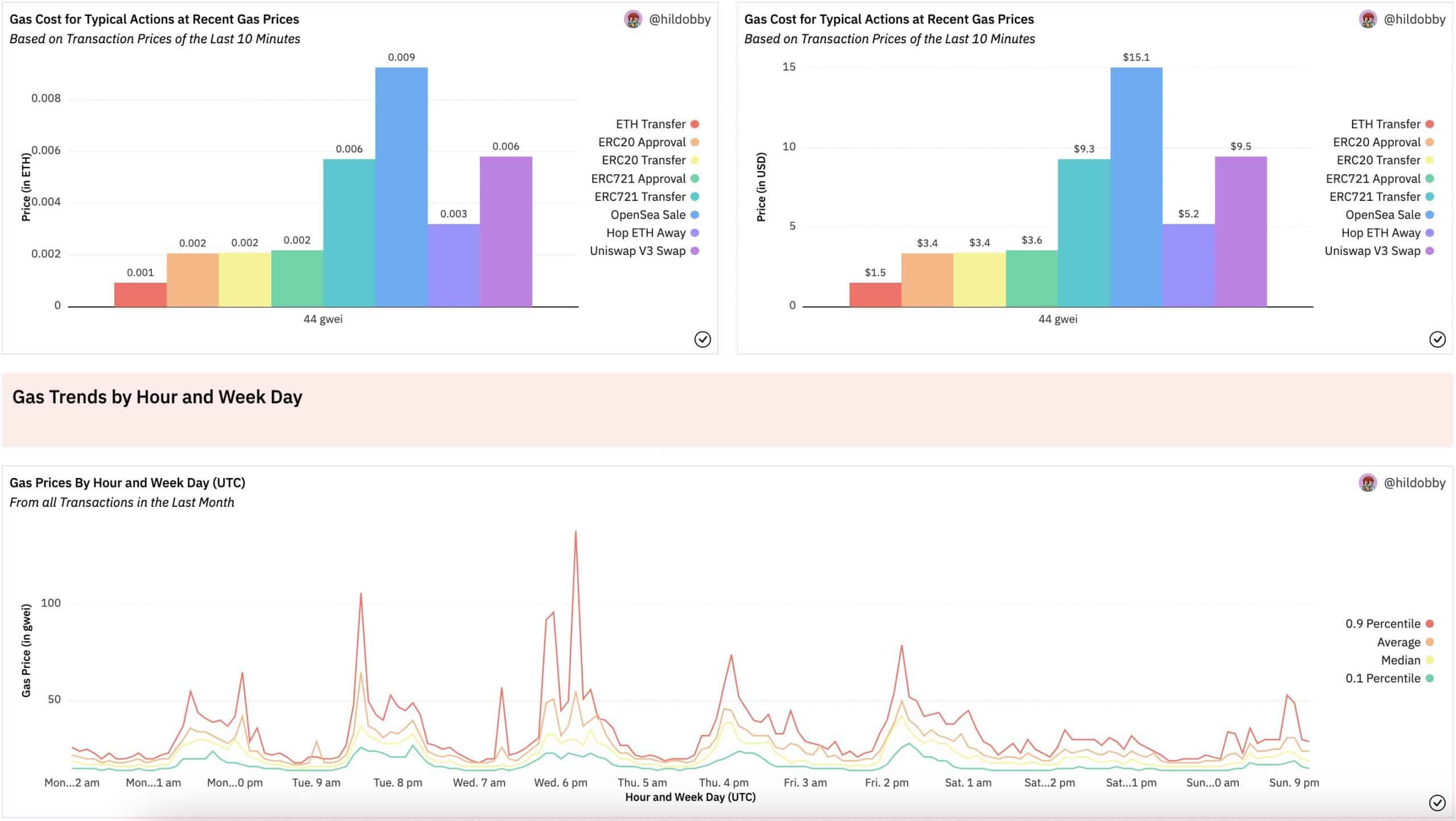

Because the Ethereum [ETH] community continues to develop, new knowledge has revealed an alarming pattern. Gasoline charges on the Ethereum community have been steadily rising because the community’s current merge. This rise in gasoline costs may hinder the adoption of Ethereum, because it might make the community inaccessible to customers who can not afford the charges.

Ever because the Ethereum merge, gasoline costs have been on an uptrend 📈

1/2🧵 pic.twitter.com/TzEl7cAgzA

— hildobby (@hildobby_) February 6, 2023

Learn Ethereum’s [ETH] Price Prediction 2023-2024

The rising gasoline costs have had a direct affect on the variety of energetic addresses on Ethereum. As the price of transactions will increase, fewer customers could also be prepared or ready to participate within the community, resulting in a decline in energetic addresses.

The NFT market will get affected

The price of transactions additionally varies relying on the kind of transaction, with the very best gasoline costs seen for Ethereum NFT transactions. This has contributed to a decline in curiosity in Ethereum NFTs, as the price of creating and buying and selling these digital property turns into more and more prohibitive.

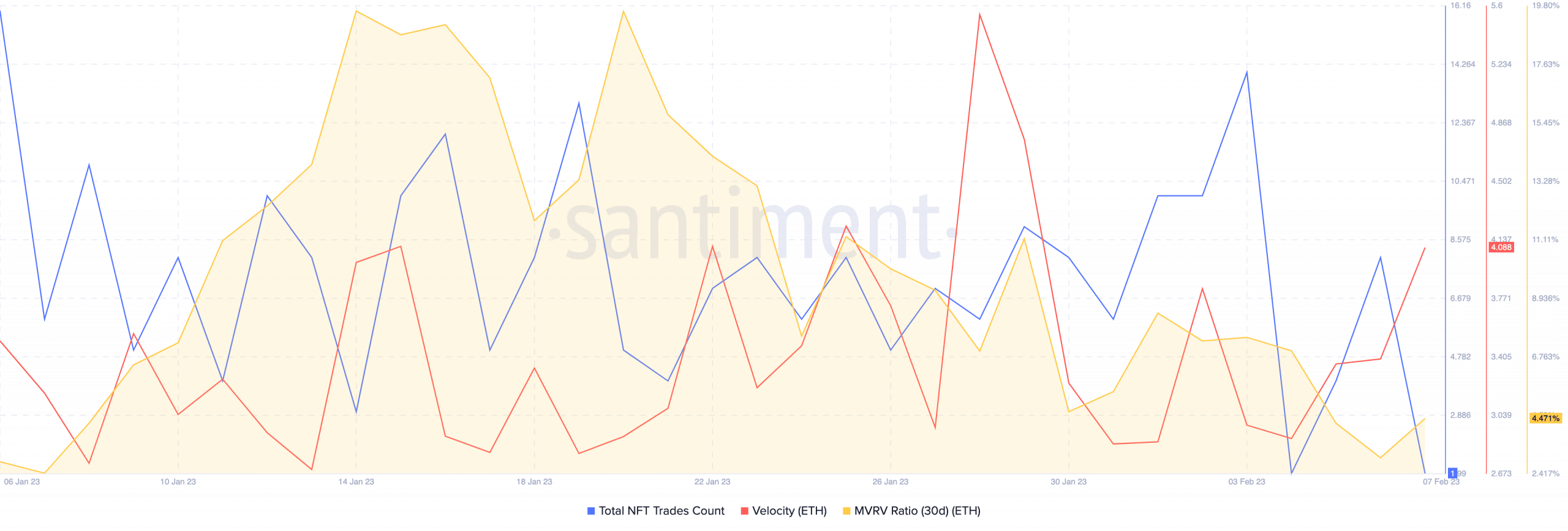

Regardless of the challenges posed by the rising gasoline costs, there are some indicators of optimism on the Ethereum community. Certainly one of these is a surge within the velocity of ETH, indicating that the frequency with which ETH is being traded amongst addresses has elevated.

On the similar time, the MVRV ratio declined, that means that almost all Ethereum holders wouldn’t make a big revenue in the event that they had been to promote their holdings presently. This diminished the promote stress on Ethereum and made it much less seemingly that the worth will drop sooner or later.

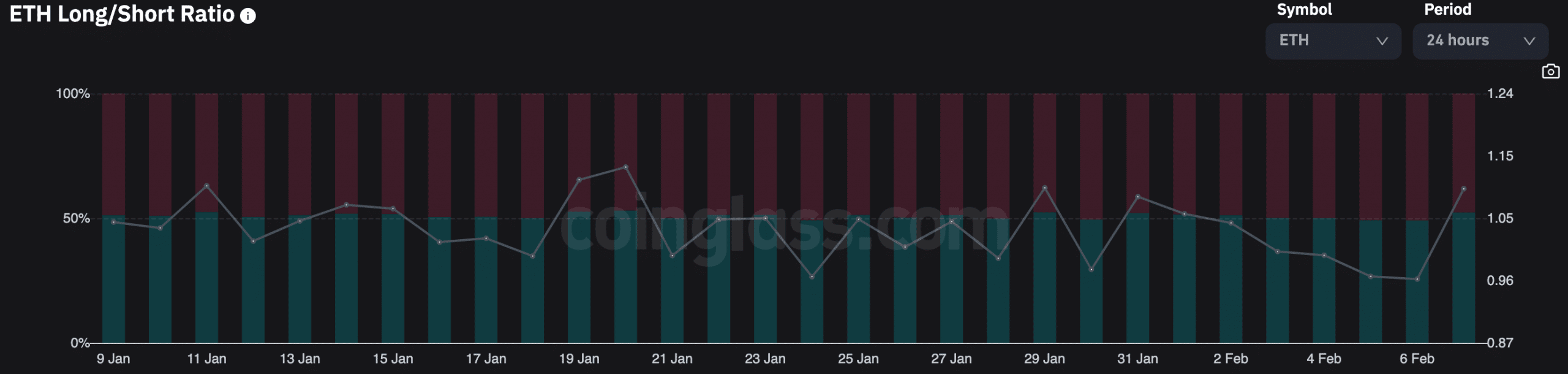

Merchants flip constructive

Moreover, merchants had been changing into more and more optimistic about Ethereum as lengthy positions on the community enhance. In keeping with Coinglass, over 52% of all positions on Ethereum had been lengthy positions. This indicated that merchants believed that the worth of ETH would proceed to rise. This rising optimism, coupled with the diminished promote stress, might contribute to a extra steady Ethereum market sooner or later.

How a lot are1,10,100 ETH worth today?

General, the rising gasoline costs on the Ethereum community are a trigger for concern for holders.

Whereas these rising prices might probably restrict the community’s adoption, there are additionally indications of rising optimism and stability within the community. Solely time will inform whether or not these constructive developments will outweigh the challenges posed by the rising gasoline costs.

[ad_2]

Source link

![Ethereum [ETH]: Rising gas fees affect not just the real world, but Web3 as well](https://crypto-newsflash.com/wp-content/uploads/2023/02/kanchanara-RhcP9Sw-cGA-unsplash-1000x600-750x375.jpg)