[ad_1]

- BTC is considerably correlated to the normal monetary markets.

- For its worth to develop, there needs to be a decoupling.

Whereas Bitcoin’s [BTC] worth might need rallied by 32% on a year-to-date (YTD), the continued development within the worth of the king coin, within the face of prevailing macroeconomic situations, is basically contingent upon its means to detach from conventional monetary markets, two CryptoQuant analysts have discovered.

Pseudonymous analyst Grizzly assessed BTC’s 200-day shifting common and its realized worth and located a sample beforehand noticed in market bottoms.

Is your portfolio inexperienced? Try the Bitcoin Profit Calculator

This sample, which suggests the formation of a long-term backside, is characterised by the crossing or overlapping of the 200-day shifting common and the realized worth, shifting from the highest to the underside. This sample was noticed in 2019, 2015, and 2012, after which BTC skilled a long-term upward development.

In response to Grizzly, in these extremely inflationary occasions, the anticipated long-term upward development would possibly observe if BTC detaches from belongings resembling equities and acts as a retailer of worth.

One other analyst Baro Virtual thought of BTC’s Internet Unrealized Revenue/Loss ratio (NUPL). The analyst discovered that the present market scenario was just like the NUPL index motion within the spring of 2019 when it broke its 365-day shifting common and BTC skilled sturdy bullish momentum.

Nonetheless, after encountering rejection on the medium-term resistance vary of 0.15-0.25, BTC’s NUPL index examined its 365-day shifting common, which served as assist.

In response to Baro Digital, a profitable maintain of the 365-day MA and overcoming the resistance vary might result in strong bullish momentum.

For the upward break to occur, BTC’s worth has to “decouple” from the broader monetary markets, Baro Digital opined. He additional acknowledged,

“Additionally crucial is the query of whether or not there will likely be a closing decoupling of Bitcoin and the US inventory market within the present cycle or whether or not Bitcoin will change into a hostage to conventional macroeconomic indicators.”

BTC market refuses to chop ties with conventional markets

On 1 February, the Federal Reserve raised rates of interest by 1 / 4 of a share level, marking the smallest rate of interest adjustment since March. On this information, BTC’s and ETH’s costs fell barely by 0.2% and 0.3%, respectively.

Learn Bitcoin’s [BTC] Price Prediction 2023-2024

It’s now not information that BTC’s worth displays excessive sensitivity to bulletins resembling inflation information or modifications in Federal Reserve rates of interest.

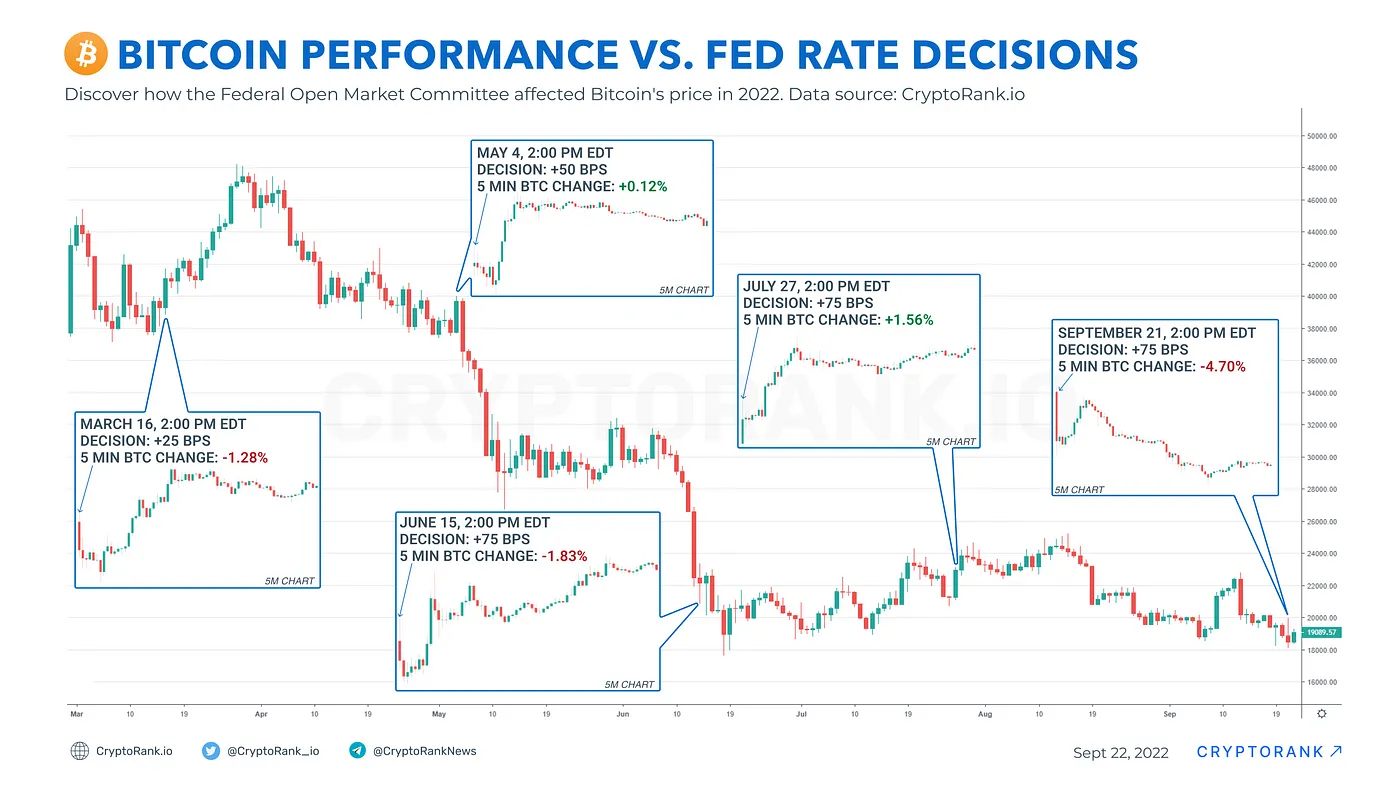

In actual fact, within the final 12 months, BTC’s worth reacted every time rates of interest have been hiked.

Through the latest Federal Reserve assembly, the Fed Chair, Jerome H. Powell, indicated that “a pair extra” rate of interest will increase have been being thought of to make sure that inflationary pressures are successfully contained.

If historical past is something to go by, one can count on BTC’s worth to react to any additional rate of interest hikes because the 12 months progresses.

[ad_2]

Source link