[ad_1]

- There’s a rising convergence between Bitcoin [BTC] and conventional shares.

- Bitcoin’s correlation with DXY is, nonetheless, nonetheless at a divergence.

After dropping for months beforehand, the worth of Bitcoin [BTC] has been growing for the reason that starting of the yr. Regardless of the numerous value improve, it’s but to recuperate to the extent that noticed it attain $60,000.

Significantly following the Covid-19 outbreak, Bitcoin’s value has correlated with conventional property. How does the BTC correlation rating now stand, and what does it imply for cryptocurrency investments?

Learn Bitcoin’s [BTC] Price Prediction 2023-24

Explaining the Bitcoin correlation rating

When evaluating the worth of Bitcoin to a different asset or basket of property, the correlation rating can be utilized to gauge the diploma to which the 2 costs transfer in tandem.

To find out the correlation, we take a look at Bitcoin and the opposite asset’s value actions over time and see how carefully they’ve tracked each other.

If the correlation rating is -1, then the values of the 2 property are completely uncorrelated with each other; if it’s zero, then there is no such thing as a affiliation between the costs of the 2 property; and if it’s 1, then there’s a excellent optimistic correlation between the costs of the 2 property (that means that the costs of the 2 property transfer in the identical course).

To assist diversify their holdings, buyers can use the correlation rating. Investing in a number of varieties of property with low correlation helps mitigate threat.

Nevertheless, it’s essential to do not forget that correlation scores can shift over time. This highlights the necessity for fixed asset correlation monitoring and subsequent investing technique changes.

Bitcoin correlation rating publish Covid-19

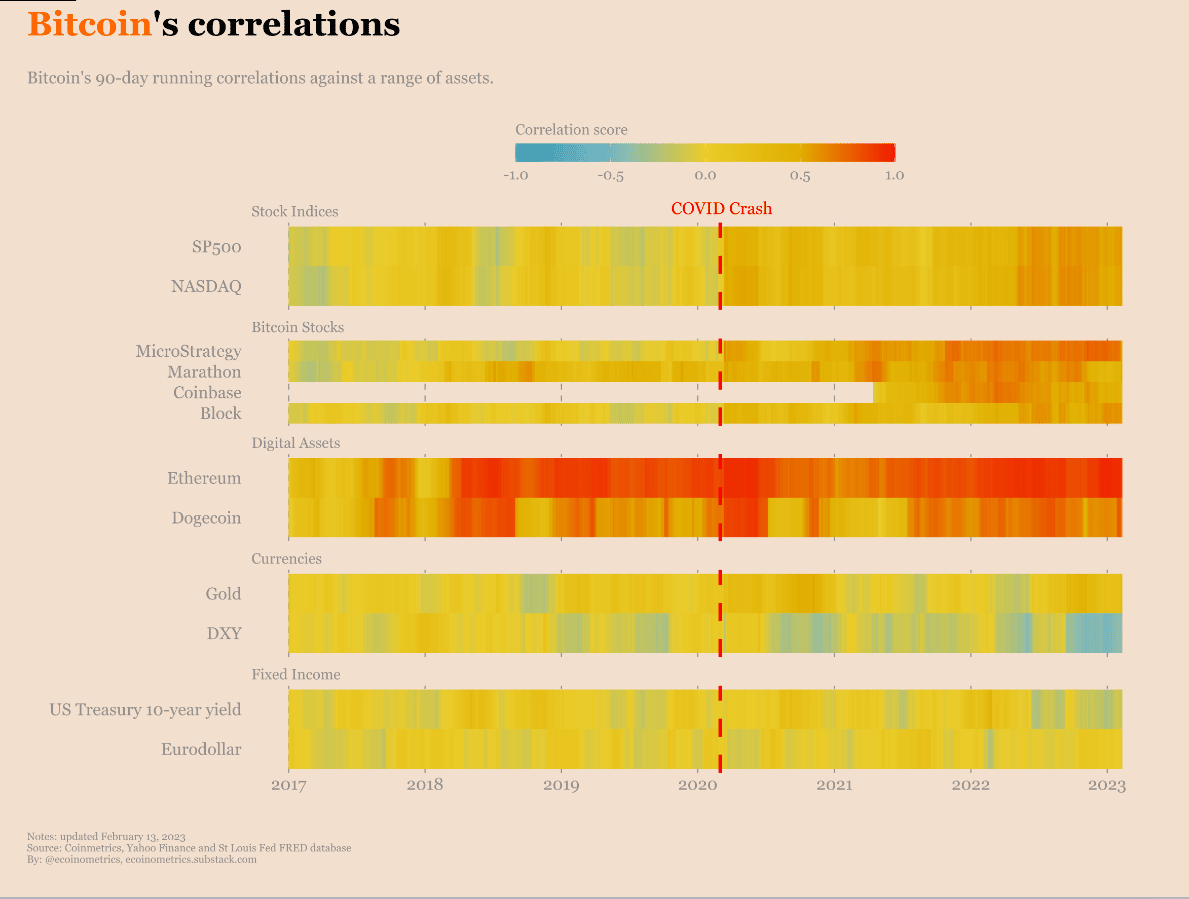

Ecoinometric knowledge reveals that following the Covid-19 epidemic, Bitcoin’s correlation rating modified considerably. Some varieties of investments have been chosen for this research in order that we may get a really feel for the correlation rating that’s now obtainable.

Inventory market indices just like the SP500 and the NASDAQ, Bitcoin shares like MicroStrategy, Marathon, Coinbase, and Block, the U.S. Greenback Index (DXY), and Eurodollar futures have been chosen to look at whether or not or not they correlate with the worth of BTC.

Effectively, apparently, Ethereum and Dogecoin have been additionally chosen to test their correlation.

Pre-March 2020 (pre-Covid), the inventory market indices have been largely unrelated to Bitcoin. After that, there’s a constant orange sample, indicating a hyperlink.

As could be anticipated, Bitcoin has a robust relationship with different cryptocurrencies. The value of Bitcoin and gold has been extremely correlated as of late, however their previous actions into and out of correlation zones.

Regardless of this, there was zero correlation between the DXY and Euro futures, both earlier than or after the outbreak. Excessive correlation is denoted by deep purple, excessive anti-correlation is denoted by deep blue, and no correlation is denoted by yellow.

BTC’s value motion

The SP500, Nasdaq, and Bitcoin Index as of this writing revealed that they have been all transferring in separate instructions.

The SP 500 and Nasdaq have been experiencing losses, however they have been lower than 1%, whereas the Bitcoin Index flashed inexperienced and recorded good points of over 1%. The DXY, nonetheless, in addition to the Euro futures, have been flashing inexperienced.

Is your portfolio inexperienced? Take a look at the Bitcoin Profit Calculator

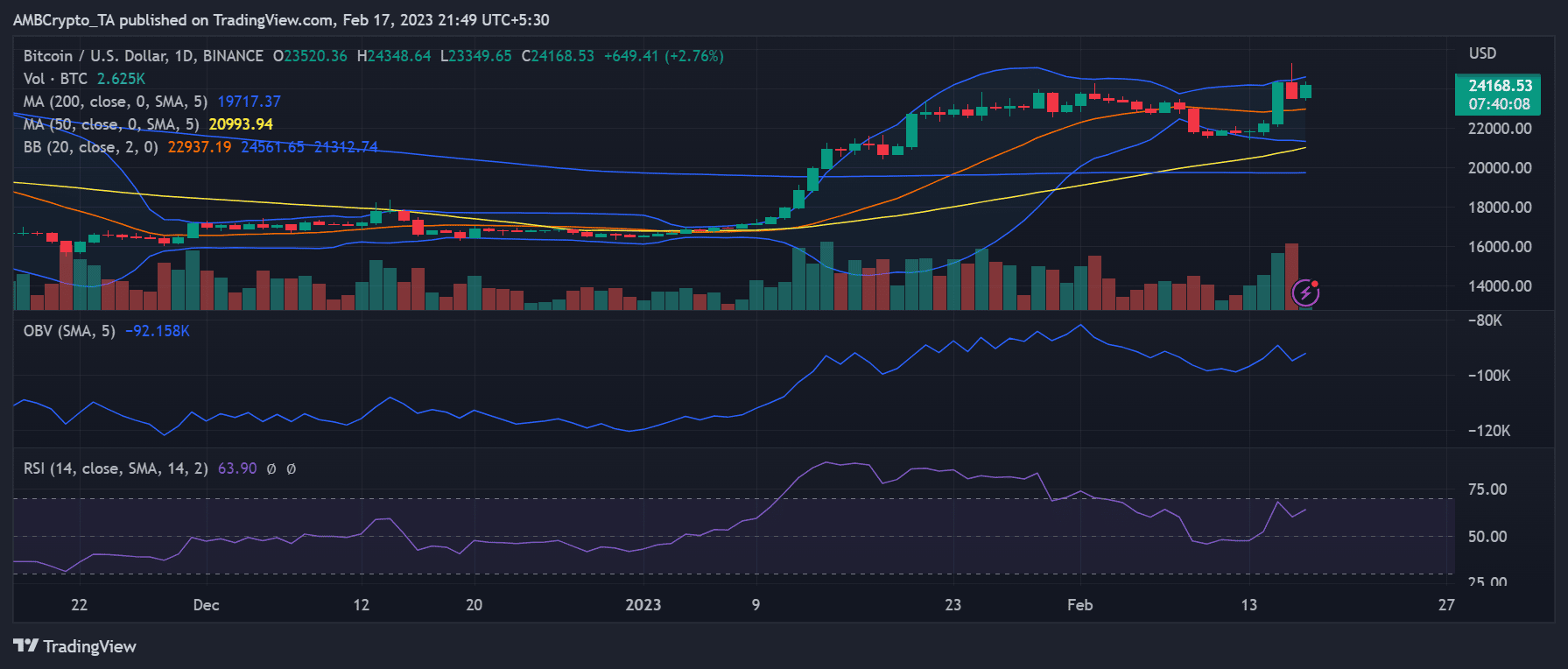

Trying on the every day chart of BTC’s value motion, we are able to see it trending upwards. A bullish development was indicated by the Relative Power Index line being above 60.

As of this writing, the worth of a single Bitcoin was simply over $23,700. It additionally mirrored a acquire of greater than 2% for the reason that begin of the buying and selling day.

[ad_2]

Source link

![A look at the Bitcoin [BTC] correlation score and its essence for investors](https://crypto-newsflash.com/wp-content/uploads/2023/02/aleksi-raisa-DCCt1CQT8Os-unsplash-1-1-1000x600-750x375.jpg)