[ad_1]

- zkEVM development might set off an enchancment in acceptance in 2023

- Regardless of the potential, the TVL of ZK rollups might maintain Ethereum again

For many of 2022, a number of Ethereum [ETH] scaling options rose to the event to assist out the blockchain’s lagging transaction velocity. This occurred with out compromising its safety and decentralization. And but, it was for that reason that Optimistic roll-ups together with Optimism [OP] and Arbitrum have been capable of acquire widespread adoption.

Is your portfolio inexperienced? Take a look at the Ethereum Profit Calculator

Roll-ups can’t go previous Optimism

Zero-knowledge (ZK) rollups have been a part of the scaling options developed to resolve the inherent scalability problem. Sadly, this group has not been capable of acquire consideration like its Optimistic counterparts, regardless of the plethora of ZK Ethereum Digital Machines (zkEVMs)

For context, the zkEVMs assist to execute good contract transactions in a appropriate method with zk proofs present on the Ethereum infrastructure. Due to this fact, this results in customizable off-chain and on-chain scaling.

Bankless, in its recent newsletter, highlighted the potential of zkEVMs replicating the optimistic rollup 2022 efficiency. However, why do these initiatives have the potential? In accordance with the blockchain perception platform, ZK rollups have the potential to turn into Ethereum’s mainstream scaling platform as a result of it might enhance the transaction velocity by 6500%.

Nevertheless, there are limitations if these rollups can attain their potential. Probably the most notable is the Complete Worth Locked (TVL) issue. The TVL describes the quantity of underlying provide secured utterly by a protocol.

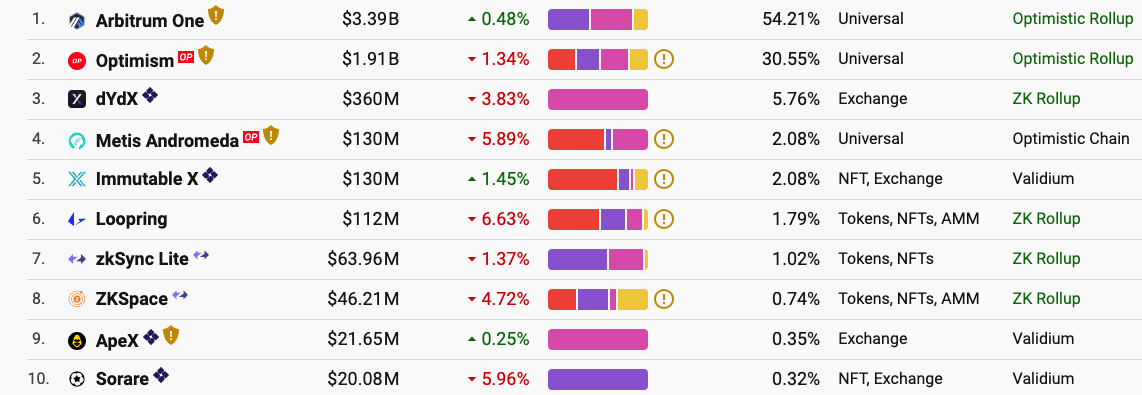

At press time, L2BEAT revealed that not one of the ZK rollups had been capable of overthrow both Arbitrum or Optimism as per this metric. The largest ZK rollup dYdX had solely a TVL of $360 million. This was far beneath the Optimistic leaders which run into billions of {dollars}. This implied a wrestle in distinctive liquid deposits to ZK rollups.

Learn Ethereum’s [ETH] Price Prediction 2023-2024

zkEVMs to the rescue?

Nevertheless, on the brighter facet, zkEVMs appear able to stability the Optimistic dominance with the layer-one (L1) initiatives. This, as a result of there have been new developments that would change the course of the scaling race. Notably, kind 1 to kind 4 zkEVMs should not holding again of their quest for compatibility with Ethereum functions.

The likes of Starknet are already at stage 3 of the method. zkSync has already launched its Mainnet for builders in February. And, extra could also be on the best way as Polygon [MATIC] has already set 27 March for its Mainnet Beta launch.

Right here, it’s price noting that Bankless admitted that it would take a while earlier than these EVMs meet up with the bottom gained by the layer-two (L2) protocols.

In conclusion, there’s no certainty that Ethereum would improve to zkEVM on-chain scaling. Nevertheless, the probabilities can’t be written off as Starknet, Polygon, and different EVM developments might drive intense adoption later within the yr.

[ad_2]

Source link