[ad_1]

- BTC traded briefly under the $20,000 value stage on 10 March, resulting in important lengthy liquidations.

- On the every day chart, elevated coin sell-offs have been noticed.

Within the early buying and selling hours of 10 March, Bitcoin [BTC] traded momentarily under the $20,000 value stage for the primary time in seven weeks, inflicting market-wide liquidations.

In keeping with information from CryptoRank, $422 million in lengthy and quick positions was liquidated from main derivatives exchanges, with 86.2% of liquidated positions being lengthy ones.

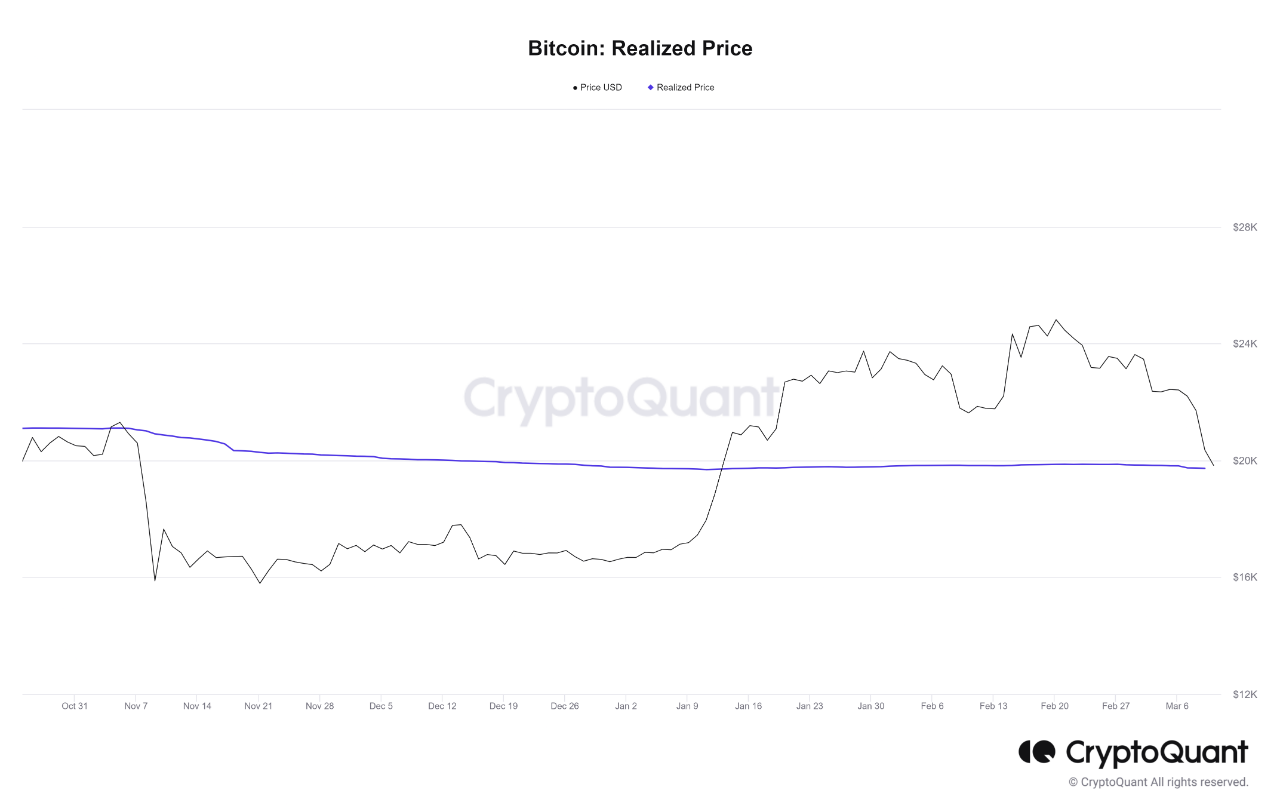

Whereas BTC reclaimed the $20,000 value stage and traded at $20,662 at press time, pseudonymous CryptoQuant analyst Crazzy Blockk discovered that the momentary decline within the king coin’s value brought about it to check the realized value of $19,700.

Is your portfolio inexperienced? Take a look at the Bitcoin Profit Calculator

In keeping with the analyst, “sustaining this stage is critical for the continued bullish outlook of the market.” That is so as a result of a sustained drop under this stage may point out a major loss in worth for BTC holders.

The bulls and bears slug it out within the open

Presently buying and selling at a five-week low, the sharp fall in BTC’s value on 10 March didn’t deter the whales from additional accumulating the king coin.

In keeping with Twitter analyst WuBlockchain, on the identical day, a number of BTC whales have been noticed shopping for name choices with a strike value of $25,000 within the April expiration and promoting the identical strike name choices for the June expiration.

Within the choices market, there have been numerous calendar unfold transactions consisting of enormous calls within the final hour, primarily concentrated in: BTC-25000-C purchase April and promote June; ETH-1600-C purchase April and promote June. @GreeksLive stated that this will likely present confidence in… https://t.co/c46OmX68vX pic.twitter.com/aGW8ZfqrUf

— Wu Blockchain (@WuBlockchain) March 10, 2023

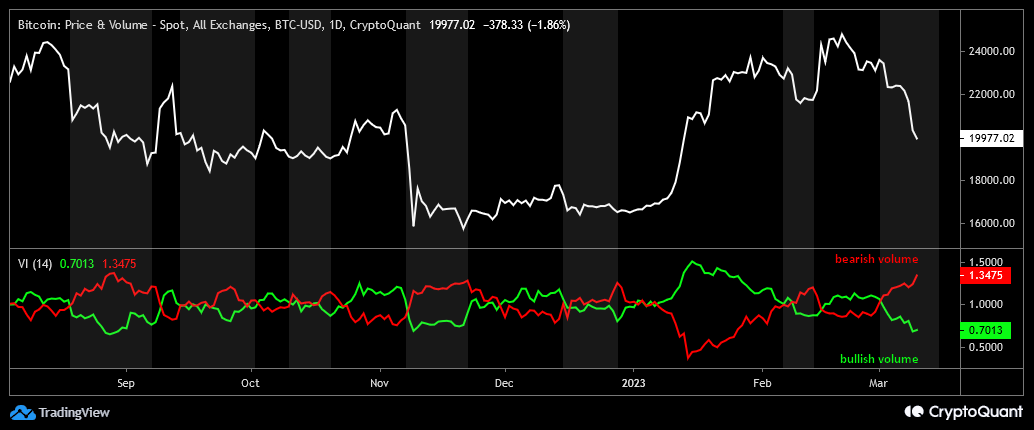

Conversely, CryptoQuant analyst Baro Virtual assessed BTC’s vortex indicator (VI) and located that “the positions of the bears started to strengthen on March 2, 2023, and proceed to strengthen till now.” In keeping with the pseudonymous analyst, BTC bears stay relentless with distribution regardless of some cool-off intervals.

Advising buyers to commerce with warning, Baro Digital warned:

“For now, vendor exhaustion mayn’t occur as a result of the domino impact because of the collapse of the FTX hasn’t but ended, and the White Home and different US authorities monetary establishments try to kick Bitcoin in each potential manner. In a phrase, uncertainty is returning to the crypto market once more.”

Redder within the coming days?

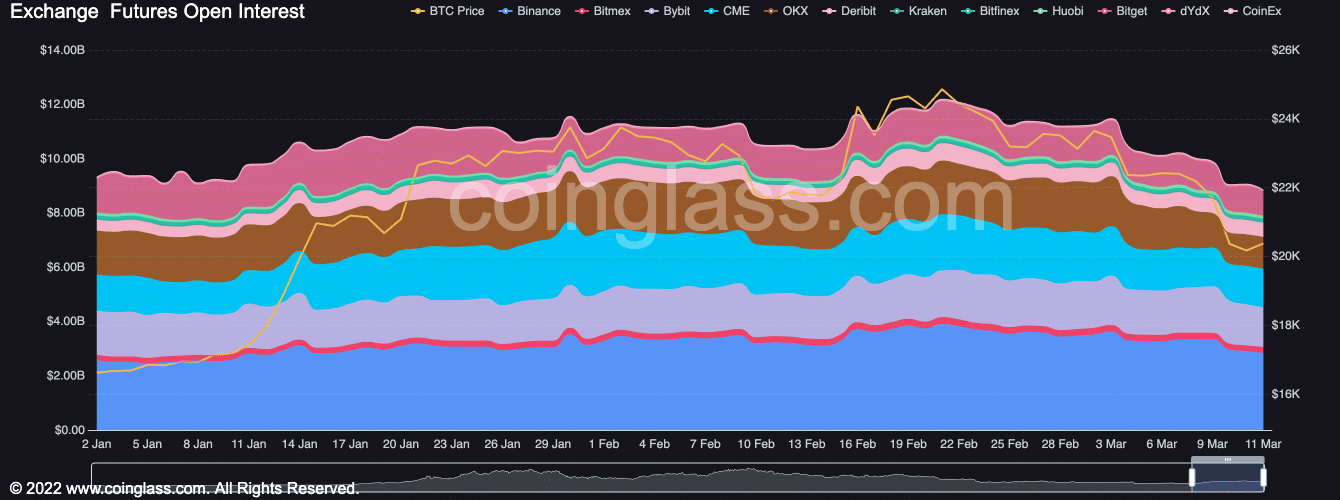

In keeping with information from Coinglass, BTC has seen a major decline in Open Curiosity previously 24 hours. As of this writing, the coin’s Open Curiosity stood at $8.834 billion. For context, the coin’s Open Curiosity has declined by 19% within the final 10 days.

On a every day chart, elevated coin distribution has compelled key momentum indicators to lie under their impartial strains. For instance, oversold at press time, BTC’s Relative Energy Index (RSI) and Cash Move Index (MFI) have been 30.52 and 29.08, respectively.

Learn Bitcoin [BTC] Price Prediction 2023-24

Additionally, the Chaikin Cash Move (CMF) was positioned in a downtrend at -0.06, under the centerline. This was a bearish sign because it meant that promoting outweighed shopping for, thus projecting an additional decline in BTC’s worth.

[ad_2]

Source link