[ad_1]

- ETH is likely to be susceptible to extra promote stress as Voyager liquidates its holdings.

- Lengthy positions shift in favor of shorts as bearish market circumstances prevail.

The ghost of 2022’s crypto contagion is but to be exorcised. A wave of ETH promote stress is likely to be on the best way courtesy of distraught crypto agency Voyager.

Practical or not, right here’s Ethereum’s market cap in BTC’s terms

Crypto analysis firm Arkham just lately confirmed that voyager has commenced the method of liquidating its digital belongings.

The corporate filed for chapter after a sequence of unlucky market occasions that led to heavy losses. Preliminary information reveal that Voyager has barely over 100,000 ETH in its addresses which can be liquidated to pay collectors.

Voyager is within the strategy of liquidating their on-chain belongings.

They’re presently sending 7-8 figures of crypto to Wintermute and Coinbase addresses day by day.

They’ve over 100K ETH remaining to unload – that is over $150M!

Arkham can be dropping a deep-dive at 12:00 EST. pic.twitter.com/XhACb5wlxa

— Arkham (@ArkhamIntel) March 9, 2023

The quantity of ETH to be liquidated is value over $150 million. The report additional revealed that the funds can be despatched to Coinbase and Wintermute addresses.

These liquidations could translate to a considerable amount of promote stress throughout the subsequent few days. Such an end result would possibly set off a deeper bearish transfer under $1,500.

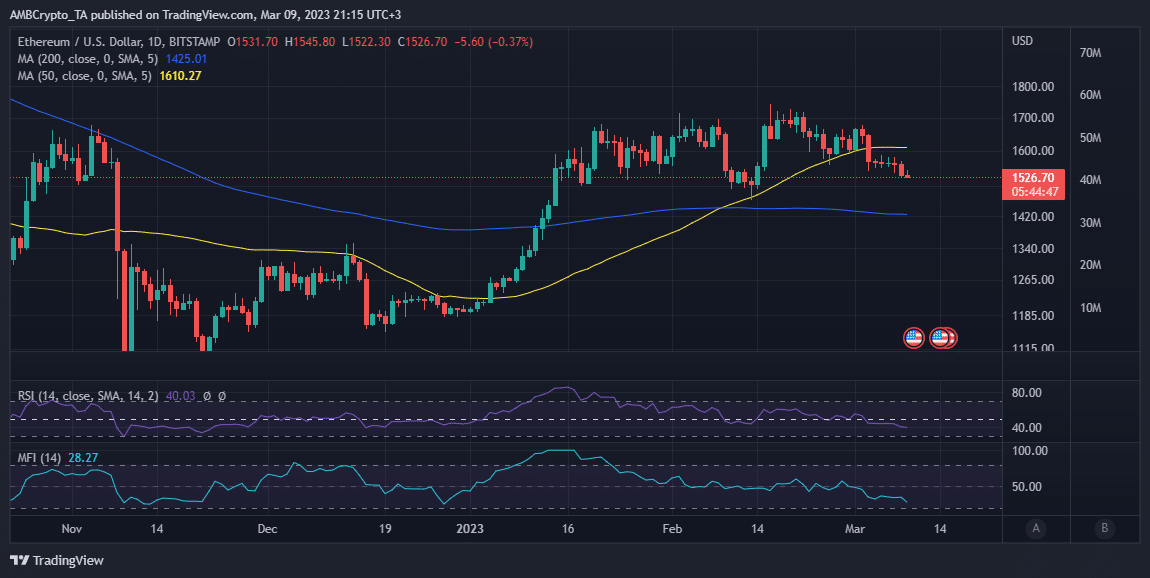

ETH bears have to this point pushed the worth down by roughly 12% from its February highs to its $1,527 press time worth. Nevertheless, the Voyager liquidations aren’t the one bearish concerns for bullish merchants.

Bullish expectations dimmed for the previous couple of weeks courtesy of anticipated charge hike will increase. Federal Reserve chairman Jerome Powell just lately reignited these bearish expectations throughout a current Senate listening to. He revealed that the FED might need to extend charges to have a greater probability at combatting inflation.

Is your portfolio inexperienced? Take a look at the Ethereum Profit Calculator

Are ETH derivatives merchants taking benefit?

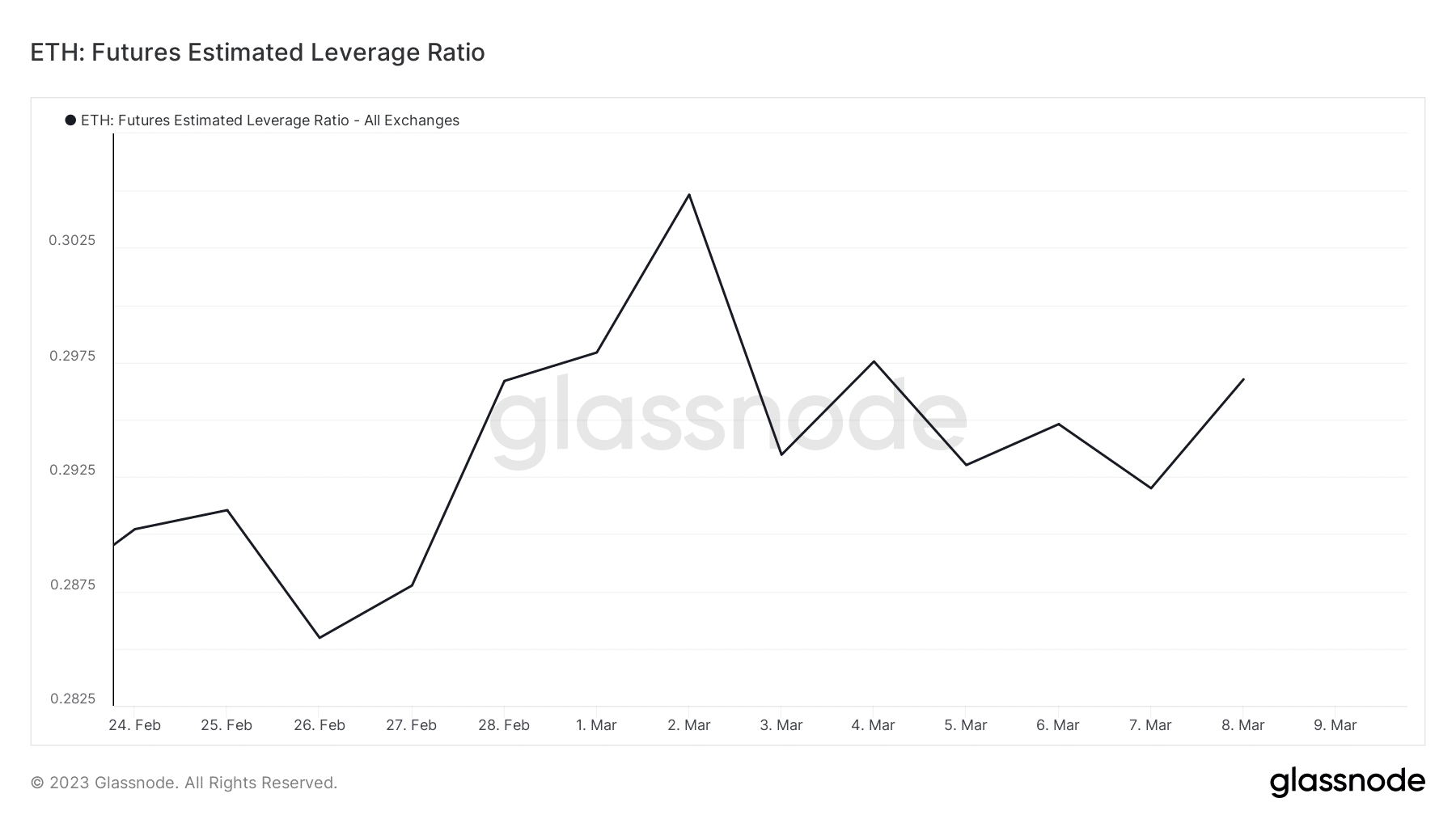

With the aforementioned issues taking heart stage, shorts merchants can be trying to take benefit. That’s seemingly the case in line with a number of metrics together with the futures estimated leverage ratio. The latter has improved over the past two weeks as costs dropped.

The surge within the futures estimated leverage ratio is especially evident within the final two days confirming wholesome demand for leverage.

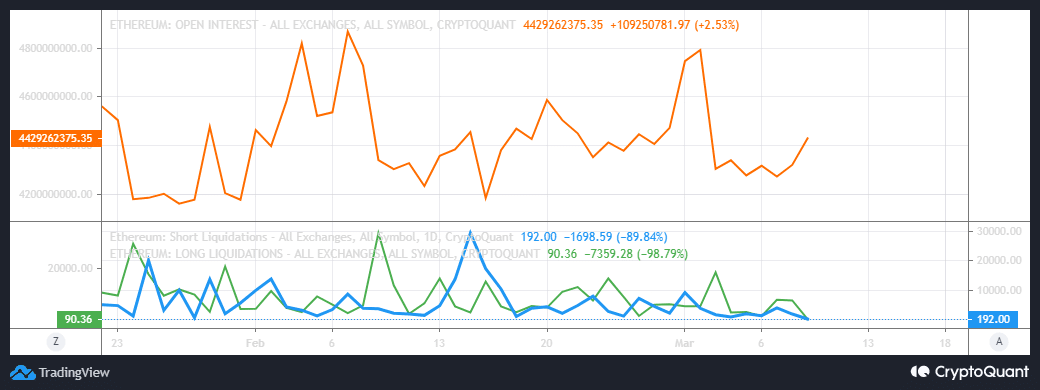

The value has been bearish throughout the identical time. Additionally, ETH’s open curiosity metric is on the rise this week and particularly within the final two days. A possible signal that there’s demand for shorts.

One other noteworthy commentary concerning the state of derivatives is that traders have shifted from lengthy positions seemingly in favor of shorts.

The longs liquidation metric reveals a drop in liquidations courtesy of the bearish market circumstances.

[ad_2]

Source link