[ad_1]

RGB and Taro, two protocols able to placing tokens like stablecoins on Bitcoin, have taken completely different approaches to fixing related issues.

That is an opinion editorial by Kishin Kato, the founding father of Trustless Providers Okay.Okay., a Japanese Lightning Community analysis and growth firm.

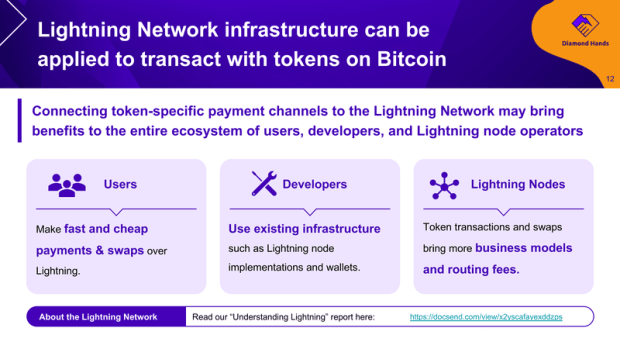

Demand for stablecoins on Bitcoin is returning because the Lightning Community gives huge scalability benefits. Presently, customers in rising markets who wish to transact and save in USD will accept stablecoins on different chains, in accordance with proponents. Placing my private emotions about these different blockchains apart, I have to acknowledge that bitcoin obtained in low-cost, cross-border remittances can not simply be bought for {dollars} whereas they reside in non-custodial Lightning channels.

RGB and Taro are two new protocols that allow token issuance on Bitcoin, and are due to this fact anticipated to deliver stablecoin transactions on Lightning. I studied these protocols and the client-side validation paradigm that they make use of and printed a report on my findings known as “Emergence Of Token Layers On Bitcoin” by way of Diamond Hands, a significant Japanese Lightning Community consumer and developer group and Bitcoin-focused resolution supplier.

Throughout this analysis, I observed refined variations in how these seemingly-similar protocols had been being developed, and have become occupied with how these variations might have an effect on their trajectories. On this article, I want to share my impressions of those initiatives and the way they could have an effect on Lightning as we all know it.

Priorities And Mindset, Revealed Via Protocol Improvement

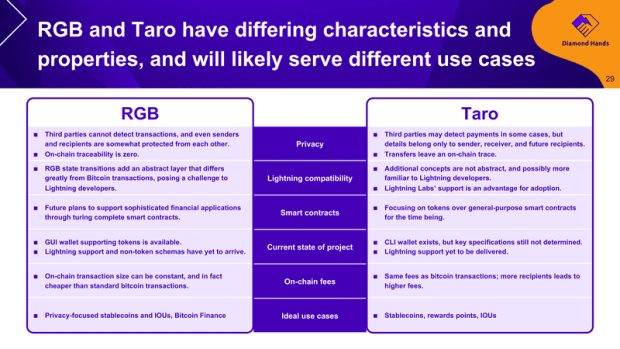

Protocol growth shouldn’t be simple, and infrequently takes years. Deciding what options to prioritize and compromise on is crucial, and one of many major differentiators between RGB and Taro is the choices they’ve made in that regard.

RGB, with its ambitions as a smart-contracting layer on prime of Bitcoin (i.e., not only for tokens), has a strong on-chain protocol to execute off-chain state transitions. Cautious design has resulted in superior privateness, on-chain scalability and flexibility, at the price of conceptual complexity. However, Taro appears to be extra targeted on off-chain use, comparable to on the Lightning Community, specifying strategies for multi-hop funds and token change. Nonetheless, among the many sensible shortcuts Taro has taken in favor of conceptual simplicity is its neglect to standardize no less than one primary constructing block of its on-chain protocol.

Since Taro property are saved utilizing an on-chain UTXO, Taro transactions can theoretically be constructed in two methods: one the place the sender pays bitcoin for the recipient’s output, and the opposite the place the recipient contributes their very own enter to pay for it themselves. The previous case is less complicated, however the sender is successfully gifting some bitcoin; the latter may be extra exact, however requires sender-recipient interplay to create the transaction. Except these strategies and their choice are standardized, pockets interoperability is a pipe dream.

Maybe Taro’s reluctance to standardize such a primary part may be defined by its strategy to growth. General, whereas RGB is being developed fairly transparently, Lightning Labs appears to order extra management over its challenge in Taro, probably to take a extra iterative, feedback-based strategy to bringing its product to market.

Certainly, as soon as a protocol is extensively adopted it’s troublesome to replace or substitute with out breaking interoperability. Nonetheless, this isn’t essentially the case in case your implementation is the one one. Lightning Labs could also be reserving its capacity to quickly iterate by deliberately suspending widespread adoption of the protocol. I acquired this impression from the aforementioned hole in standardization, in addition to the truth that Lightning Labs plans to ship its Taro wallet with LND, its Lightning node implementation with more than 90% market share.

It’s definitely doable that Lightning Labs’ strategy will likely be extra profitable at bringing tokens to Lightning. However until it surrenders its dominant function sooner or later, Taro dangers changing into little greater than an LND API. It isn’t unimaginable to me that Taro will stay an LND-specific function.

Will Lightning Survive Tokens?

As a semi-paranoid Bitcoiner, I have to surprise if the proliferation of tokens on Bitcoin will end in detrimental penalties for the Lightning Community or Bitcoin itself. Whereas considerations of the latter are validated by Circle’s (the issuer of USDC) ability to influence users during any potential contentious hard fork in Ethereum, I want to level out a selected avenue of concern for Lightning.

As talked about earlier, Taro’s strategy if continued will outcome within the elevated utility of LND by way of use of its included Taro pockets, in relation to different implementations. This could doubtlessly additional lock in LND’s dominant place within the node implementation panorama. To maintain Lightning decentralized, it’s preferable that customers are unfold extra evenly throughout a number of implementations, in order that even the most well-liked implementation can not merely implement protocol modifications with out consequence to its customers.

Whereas I personally am not a fan of the overwhelming majority of crypto tokens, I do consider that the Lightning Community has one thing to prospectively supply customers of such tokens: quick, personal and decentralized change and funds. With the ability to pay somebody of their native or most popular forex immediately, with out the sender proudly owning any of it, has immense potential to disrupt present fee and remittance rails. Although it’s unclear what protocol will prevail for token issuance on Bitcoin, I hope that proliferation of tokens is not going to sacrifice the issues that bitcoin and Lightning stand for.

This can be a visitor submit by Kishin Kato. Opinions expressed are completely their very own and don’t essentially replicate these of BTC Inc or Bitcoin Journal.

[ad_2]

Source link