[ad_1]

Because the Fed intervenes as a way to forestall a disaster within the US banking system, analysts reply whether or not the Fed has chosen to pivot from its quantitative tightening measures.

The banking disaster final week within the US pushed Wall Avenue to the sting giving glimpses of yet one more 2008-like monetary disaster. Nevertheless, the Fed and different companies intervened pumping a recent $300 billion into the economic system and thus growing its steadiness sheet.

This has served as a short lived oxygen to the worldwide market as all of the top-three US indices gained considerably on Thursday, March 16. This $300 billion got here from the Fed’s emergency liquidity facility and shall assist the troubled banks to satisfy their short-term liquidity wants.

The US banks borrowed roughly $164 billion mixed from the Federal Reserve. Apart from, the Federal regulators and companies supplied an extra $140 billion “to the brand new bridge banks for Silicon Valley Financial institution and Signature Financial institution established by the Federal Deposit Insurance coverage Corp,” reported Reuters.

In consequence, the Fed’s complete steadiness sheet swelled as soon as once more by $300 billion. These measures result in the substantial discount of steadiness sheet discount efforts that the Fed was endeavor over the past six months.

Some analysts are, nevertheless, blissful that the Fed’s intervention has helped to forestall the contagion from spreading to different banks. Thomas Simons, cash market economist with funding financial institution Jefferies mentioned:

The numbers, as we see them proper right here, are extra according to the concept that that is simply an idiosyncratic concern at a handful of banks. The federal government’s assist efforts seem more likely to work and the scale of the numbers reported by the Fed Thursday recommend “it’s not like an enormous system-wide downside”.

Has the Fed Pivot to Quantitative Easing?

The current motion from the Fed reveals that the Fed is recalibrating its efforts of financial tightening and may appear to pivot as soon as once more in the direction of quantitative easing. All eyes are at present on the Fed assembly subsequent week the place analysts expect a pause in charge hikes or a 25 foundation factors hike on the max.

Nevertheless, the present market mayhem hasn’t stopped the European Central Financial institution from persevering with with charge hikes. On Thursday, the ECB introduced one other 50 foundation factors hike regardless of the Credit score Suisse disaster unraveling this week.

The US Greenback jumped on Thursday, because the Fed introduced its resolution to pump $300 billion into the economic system. Though the Fed will increase its steadiness sheet, that is no quantitative easing writes Daniel Dubrovsky, senior strategist at Each day FX. He wrote:

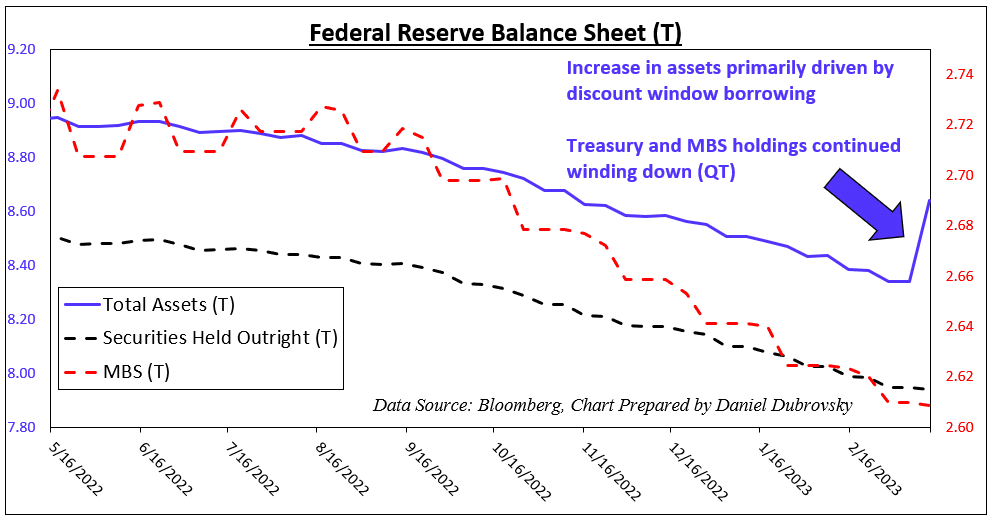

“Make no mistake, this isn’t quantitative easing. On the chart under, you’ll be able to see that whereas total holdings rose, securities held outright (largely Treasuries) and mortgage-backed securities (MBS) continued shrinking as one would anticipate beneath quantitative tightening.”

Courtesy: Each day FX

Bitcoin and Crypto Market Bounce

Simply because the US equities rallied on Thursday, Bitcoin and the broader cryptocurrency market joined the social gathering. The world’s largest crypto Bitcoin (BTC) is up by 7.39% over the past 24 hours and at present buying and selling at $26,756 and a market cap of $517 billion.

Altcoins too have joined the social gathering with all the highest ten altcoins gaining wherever between 5-10%. The broader crypto market has added greater than $70 billion to buyers’ wealth.

Bhushan is a FinTech fanatic and holds an excellent aptitude in understanding monetary markets. His curiosity in economics and finance draw his consideration in the direction of the brand new rising Blockchain Expertise and Cryptocurrency markets. He’s repeatedly in a studying course of and retains himself motivated by sharing his acquired data. In free time he reads thriller fictions novels and typically discover his culinary expertise.

Subscribe to our telegram channel.

Join

[ad_2]

Source link