[ad_1]

On-chain information exhibits the Ethereum transaction price has remained low regardless of the current worth rise. Right here’s what this may occasionally imply for the market.

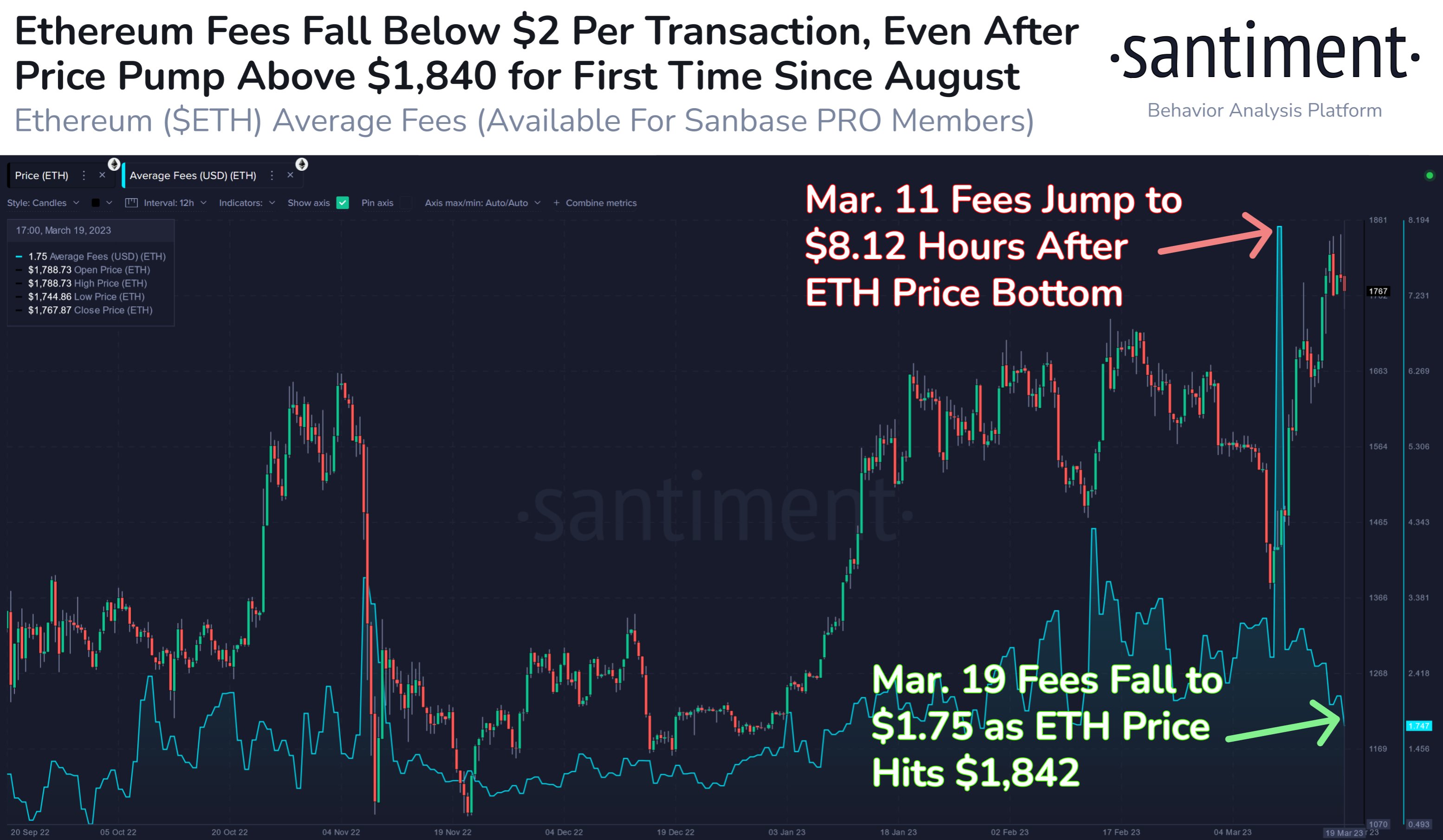

Ethereum Charges Noticed Large Spike Throughout The Native Backside

As per information from the on-chain analytics agency Santiment, the ETH transaction price has fallen beneath $2 per switch now. The related indicator right here is the “average fees,” which measures the overall quantity of charges (in USD) that buyers have to connect to their Ethereum transaction to ensure that it to undergo on the blockchain.

The worth of this metric can fluctuate relying on the site visitors that the community is receiving. Usually, when there are numerous transfers taking place directly, transactions might take extra time to be executed. So, those who need their transfers to undergo rapidly throughout such occasions of congestion merely connect a better price with their transactions to make it possible for they’re prioritized by the community.

However, when there aren’t many customers making strikes on the chain, the typical charges can plummet since there aren’t many buyers competing in opposition to one another to get their transactions executed faster anymore.

Due to this relationship, the typical charges indicator can present perception into whether or not the Ethereum community is seeing a high amount of activity or not in the intervening time.

Now, here’s a chart that exhibits the development within the ETH common charges over the previous couple of months:

Seems like the worth of the metric has noticed some decline in current days | Supply: CryptoQuant

As displayed within the above graph, the Ethereum common charges had seen some fairly excessive values earlier within the month when the ETH worth had plunged and hit a neighborhood backside.

Throughout this spike, the indicator had reached a peak of about $8.12, suggesting that holders had been lively again then. This excessive community site visitors naturally got here partly from those that had been making use of promoting stress on the coin, thus the decline within the worth.

Nonetheless, that wasn’t all. The excessive charges would have additionally been a results of the consumers dashing in to purchase the cryptocurrency on the low costs, therefore why the asset’s worth sharply shot up not too lengthy after.

Ethereum has continued this recent worth surge just lately, with the asset even managing to interrupt above $1,800 briefly through the weekend, a degree that the coin hadn’t beforehand reached since August 2022.

As this rise within the worth of Ethereum has occurred, nonetheless, the typical charges have solely trended down. Now, the indicator’s worth has dropped to only $1.75, implying that the community isn’t too scorching proper now regardless of the rally.

Santiment thinks that this could possibly be a superb signal for ETH because it means the value wouldn’t encounter any notable transaction boundaries presently, one thing that would assist open the door to $2,000 for the asset.

ETH Worth

On the time of writing, Ethereum is buying and selling round $1,780, up 12% within the final week.

ETH appears to have shot up just lately | Supply: ETHUSD on TradingView

Featured picture from DrawKit Illustrations on Unsplash.com, charts from TradingView.com, Santiment.web

[ad_2]

Source link