[ad_1]

This text is an on-site model of our Unhedged publication. Join here to get the publication despatched straight to your inbox each weekday

Good morning. Right here at Unhedged our predominant venture for the remainder of this week is ignoring the indictment of a second-tier actual property developer from Florida. However that ought to depart us with a number of different issues to put in writing about. E-mail us your concepts: robert.armstrong@ft.com and ethan.wu@ft.com.

Opec flexes, markets unimpressed

Oil rose greater than 6 per cent, to $85, yesterday. This was in response Opec’s announcement, over the weekend, that Saudi Arabia would cut its manufacturing by 5 per cent, and that members of the Opec+ cartel would comply with with cuts of their very own. The transfer was wealthy with political implications. Many analysts argue it marks a strategic change by the Saudis and their allies, slightly than a tactical transfer to defend a weak oil value. From the FT:

“It’s a Saudi-first coverage. They’re making new pals, as we noticed with China,” [Helima Croft, of RBC Capital Markets] stated, referring to a latest Beijing-brokered diplomatic deal between Saudi Arabia and Iran. The dominion was sending a message to the US that “it’s now not a unipolar world”.

This feels like critical stuff to us. So we have been struck by how little markets responded on Monday. Shares leveraged to grease, from upstream manufacturing to oilfield providers, popped. However on condition that sustained increased oil costs are stagflationary, we have been a bit shocked to see beneficial properties throughout quite a lot of different sectors (healthcare, supplies, staples). Extra stunning nonetheless, the policy-sensitive two-year bond yield fell 9 foundation factors.

That is notably notable on condition that Opec+ has a traditionally excessive degree of management over oil costs proper now, as Goldman Sachs’s Daan Struyven has argued. The addition of the “+” nations (Russia, Kazakhstan, Mexico et al) to the cartel have elevated its market share. Higher monetary self-discipline from non-Opec producers, notably the US, has decreased the worth elasticity of world provide. And world demand has develop into extra inelastic as a result of (amongst different causes) transportation gasoline, which has few substitutes, now makes up a better share of complete demand. If Opec+ desires play for sustained increased oil costs, it’s holding good playing cards.

Moreover, as our colleague Derek Brower of FT Energy Source identified to us, many analysts have been already mentioning that oil was positioned for a rally within the second half of 2023, as resurgent demand from China pushed the market into deficit. Struyven, for instance, has been saying for months that oil would cross $100 by year-end.

Even when increased oil shouldn’t be sufficient to alter the expansion outlook materially, we’d count on some fear in regards to the inflationary results, given the market’s monomaniacal give attention to Federal Reserve coverage. Vitality is 7 per cent of CPI, and has a strong impression even on core (ex-food and power) CPI by way of transportation providers, which has been a vital swing issue within the inflation measures the Fed cares about most.

So why the indifference? As soon as once more, it appears to us just like the comfortable touchdown state of affairs is exercising a hypnotic impact available on the market. Should you suppose there’s a actual menace the financial system will maintain operating too sizzling, the extra inflationary results of excessive oil costs are an unwelcome extra danger. Should you suppose the central forecast is for demand softening sufficient to convey down inflation, then sustained increased oil costs don’t appear that a lot of a menace.

For instance, right here is Capital Economics’ Adam Hoyes:

The [initial] strikes within the bond market [with inflation breakevens rising following the Opec + announcement] have greater than reversed for the reason that launch of the March ISM Manufacturing survey, the place the headline index slumped to a brand new cyclical low and different indices pointed to an extra easing in value pressures. We wouldn’t be shocked if this sample — increased oil costs however decrease Treasury yields — continued over the remainder of this yr, despite the fact that they’ve usually moved collectively. Admittedly, we do suppose oil demand is about to be weak over the remainder of this yr, with progress in lots of main economies more likely to be sluggish at finest.

Hoyes, and varied different analysts who struck comparable notes, might very nicely be proper. Our level is simply that there’s a part of the likelihood distribution (20 per cent of it?) the place the labour market stays too tight, and financial system doesn’t cool materially, and the Fed has to maintain charges excessive. In that tail of the curve, increased oil costs might be an actual downside.

Bitcoin’s new outdated narrative

Bitcoin’s 70 per cent ascent this yr occurred in two phases. The primary was the flight-to-shite that started the yr, as goals of a comfortable touchdown and decrease rates of interest set off a rally in all method of high-duration junk. The second was the fallout from Silicon Valley Financial institution’s collapse. As bond yields fell, bitcoin’s value popped. Flows into crypto funding merchandise are at their highest since mid-2022, in response to CoinShares.

After a run of eerily stable value motion within the second half of final yr, this can be a massive change. A rally amid a banking panic is catnip for bitcoiners. And the brand new crypto story is identical outdated crypto story: persons are quick shedding confidence in banks and are flocking to bitcoin.

Right here, for instance, is Balaji Srinivasan, previously a prime determine at Coinbase and Andreesen Horowitz, spinning a yarn final month about why a “stealth monetary disaster” is poised to result in hyperinflation and mass bitcoin adoption. He claims to have guess $1mn this can occur by June:

The central banks, the banks, and the banking regulators all knew an enormous crash was coming — the phrase is “unrealised losses”. However they by no means notified you, the depositor . . .

It’s Uncle Sam Bankman-Fried. Identical to SBF used your deposits to purchase shitcoins, utilizing accounting methods to idiot himself and others into utilizing the cash, so too did the banks . . .

All of them used the deposits to purchase the final word shitcoin: long-dated US Treasuries. They usually all received [wrecked] on the identical time, in the identical approach, as a result of they purchased the identical asset from the identical vendor who devalued it on the identical time: the Fed . . .

So anybody who guess on long-term Treasuries received killed in 2021. And now, anybody who bets on short-term Treasuries goes to get killed in 2023. Absolutely the worst place you could be is to have massive quantities of belongings locked up in three-month treasury payments. The ~5 per cent rate of interest supplied by massive banks (G-SIBs) is a entice. Most fiat financial institution accounts are actually a entice, for these nations whose central bankers adopted the Fed . . .

That is the second that the world redenominates on Bitcoin as digital gold, returning to a mannequin very like earlier than the twentieth century.

It is a bit loony (what’s the worst-case state of affairs for three-month Treasuries yielding 4.6 per cent?), although first chunk of Srinivasan’s story is legible. Whether or not banks ought to’ve accounted for mark-to-market losses on long-dated securities is a live debate. However we are able to’t make the leap from “long-term Treasuries received killed” to “the world is about to drop fiat forex”.

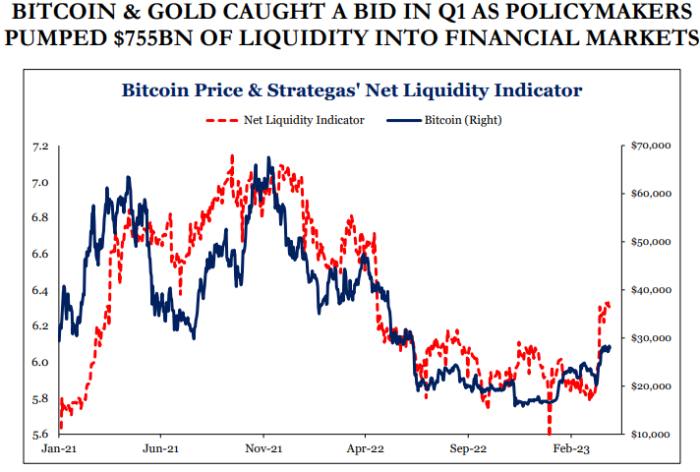

There’s a extra credible story for bitcoin’s bumper quarter: liquidity. Daniel Clifton at Strategas calculates that US policymakers, on internet, injected $755bn in liquidity within the first quarter of this yr, whereas they have been internet subtracters of liquidity all by way of final yr. The correlation between adjustments in liquidity and bitcoin’s value appears tight:

Why ought to liquidity injections assist bitcoin? We appreciated this illustration from Citi strategist Matt King, on Bloomberg’s Odd Tons podcast final week, of how traders get crowded into riskier belongings:

For me, it’s actually about this stability between how a lot cash the non-public sector has relative to what number of belongings can be found to soak up that cash . . .

You possibly can’t see all these shifting components, however what I feel goes on is that the man who would’ve purchased payments buys bonds, the man who would’ve purchased bonds buys IG credit score, the man who would’ve purchased IG buys high-yield, and so forth . . .

The most effective correlations [with central bank liquidity injections] I discover of all are precisely with the preferred belongings like cryptocurrency or Tesla inventory.

On this sense the banking disaster, in forcing a brand new spherical of liquidity assist, actually has helped bitcoin past the narrative increase, although not for the explanations Srinivasan suggests. Systemic stresses elevate bitcoin not as a result of they discredit the monetary system, however as a result of the regulatory responses are good for speculators. (Ethan Wu)

One good learn

Some fascinating hedge fund sniping: Derek Kaufman (former Citadel), Boaz Weinstein (Saba Capital) and Cliff Asness (AQR) don’t like how Mark Spitznagel (Universa) calculates his returns.

[ad_2]

Source link