[ad_1]

Crypto derivatives trade Deribit is launching free buying and selling of bitcoin and different tokens, establishing a recent worth warfare amongst digital asset exchanges as they search to re-emerge after a bruising 12 months for the business.

The Panama-based group, the world’s largest crypto choices trade, will start direct buying and selling in three of the most well-liked cryptocurrency pairs from subsequent week and waive the charges.

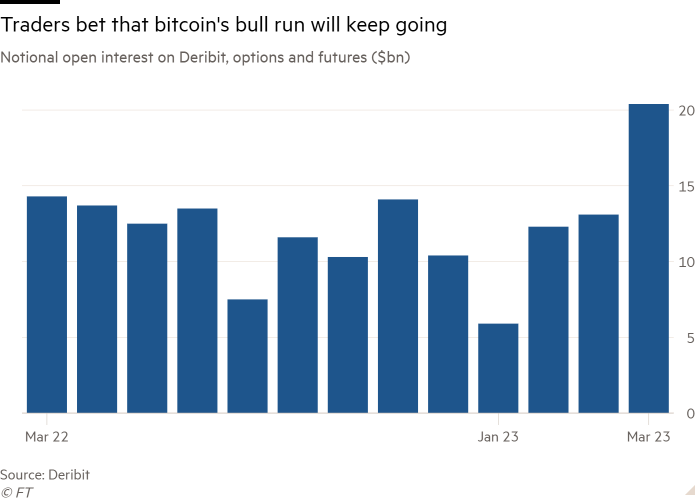

Its transfer underscores how competitors is heating up amongst crypto exchanges as they attempt to entice institutional buyers eager to get right into a rising market after the crash in digital asset prices final 12 months and the failure of business bellwether FTX. Round 90 per cent of Deribit’s clients are institutional purchasers.

Widespread cash corresponding to bitcoin and ether have outperformed belongings corresponding to shares and commodities this 12 months, rising 50 per cent and 65 per cent respectively.

It additionally comes a month after Binance, the world’s largest market for crypto buying and selling, ended a six-month foray into zero-fee buying and selling, a transfer that accelerated its market share.

Luuk Strijers, chief business officer at Deribit, stated the trade’s transfer into spot buying and selling was pushed by buyer demand.

“You would need to purchase ether on Binance as an alternative of Deribit,” he stated, including: “If you wish to convert $5mn [into bitcoin], for instance, we must inform you to go elsewhere, which is horrible customer support.”

“With the intention to have a correct derivatives providing you additionally must have spot,” he added.

Large-name cash managers have continued to discover digital belongings and monetise investor curiosity up to now 12 months, even because the business suffered a confidence disaster and lots of corporations failed.

“Critical institutional gamers stay dedicated and, actually, see the open house after the demise of a number of crypto-native gamers as a chance.” Bernstein analysts wrote this week.

Deribit will supply free buying and selling in pairs of ether and bitcoin, and ether and bitcoin in opposition to the stablecoin USDC, which is operated by Circle. US-listed Coinbase expenses as much as 0.6 per cent for a commerce, for instance.

Strijers added that buying and selling on the three pairs would stay free to commerce “for the foreseeable future” and that future tokens that is likely to be added would have a cost.

The market share of Binance soared by a fifth after launching fee-free buying and selling in 13 cash and at reached almost two-thirds of complete quantity on the trade, in response to knowledge supplier Kaiko. Nonetheless the trade’s lead fell again after it reintroduced expenses.

Deribit added that it was trying to make use of spot buying and selling as an entry for patrons to commerce choices and futures. Strijers stated this might “service our current consumer base and doubtlessly appeal to some new purchasers who then . . . will even commerce choices, futures or perpetual [futures]”.

Deribit was based in 2016 and is backed by buyers together with crypto enterprise agency 10T Holdings and buying and selling agency Akuna Capital.

[ad_2]

Source link