[ad_1]

On-chain knowledge reveals the Bitcoin buying and selling quantity has been rising whereas curiosity across the altcoins has continued to be low lately.

Bitcoin Buying and selling Quantity Lately Crossed Above The $30 Billion Mark

In response to knowledge from the on-chain analytics agency Santiment, altcoins at the moment are drawing decrease and decrease curiosity as BTC’s worth dominance strengthens. The “trading volume” is an indicator that measures the each day complete quantity of a cryptocurrency (in USD) that’s being transacted on the blockchain.

When the worth of this metric is excessive, it means a lot of tokens of the asset in query are being moved round on the community proper now. Such a pattern means that merchants are lively out there at the moment.

However, low values of the indicator recommend the cryptocurrency isn’t seeing a lot exercise on the blockchain in the intervening time. This generally is a signal that the final curiosity within the asset is low amongst buyers.

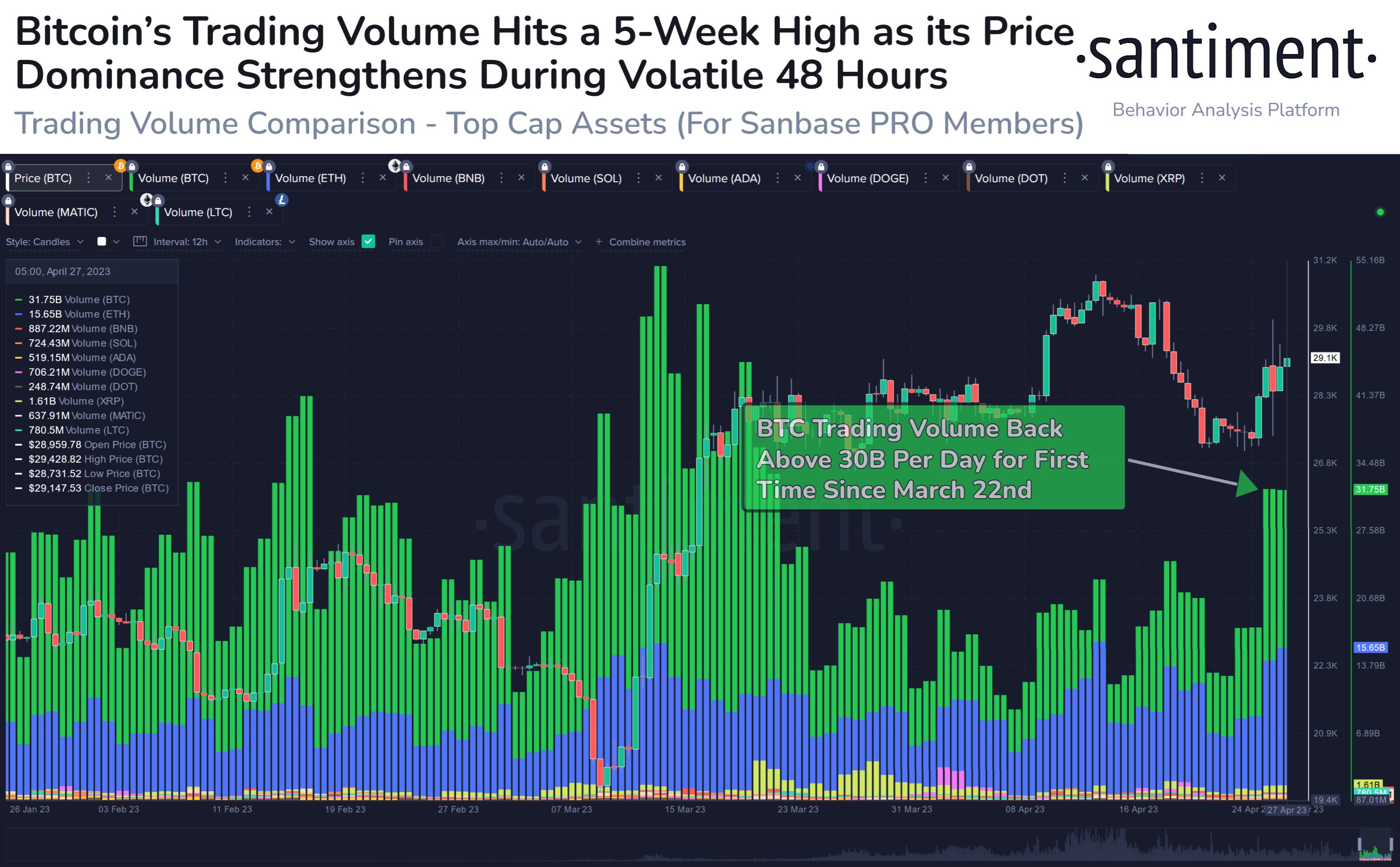

Now, here’s a chart that reveals the pattern within the buying and selling quantity of the highest 10 cryptocurrencies by market cap (excluding the stablecoins) over the previous couple of months:

Seems to be like the worth of the metric has been fairly excessive in latest days | Supply: Santiment on Twitter

As displayed within the above graph, the Bitcoin buying and selling quantity has sharply surged lately as the value of the cryptocurrency has noticed some pretty high volatility.

This type of pattern is nothing out of the extraordinary, as excessive bursts of volatility can deliver lots of consideration to the asset since buyers usually discover such occasions to be thrilling. New merchants naturally get drawn to the blockchain throughout these durations, and previous ones additionally react to the value motion by repositioning themselves.

As the newest excessive volatility occasion was fairly violent, the buying and selling quantity ranges touched throughout it have been considerably greater than these noticed throughout the previous month. At its latest peak, the indicator broke above the $30 billion mark, which is the very best it has been since March 22, 2023.

From the chart, it’s seen that Ethereum’s buying and selling quantity additionally noticed a lift throughout this era, however the rise hasn’t been fairly as vital as what Bitcoin has noticed.

The altcoin buying and selling quantity normally has remained at fairly low ranges regardless of the latest volatility, suggesting that buyers are largely specializing in BTC proper now.

The explanation behind this low altcoin curiosity is more likely to be the truth that the BTC worth has displayed energy lately, because it has outperformed all of the cash on this checklist over the last seven days.

The volatility skilled by the number one cryptocurrency has additionally been greater normally than what the altcoins have skilled, additional explaining why holders could also be paying extra consideration to it.

BTC Value

On the time of writing, Bitcoin is buying and selling round $29,200, up 4% within the final week.

BTC has displayed excessive volatility in the previous couple of days | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Santiment.web

[ad_2]

Source link