[ad_1]

On-chain information suggests a majority of the Bitcoin change inflows are at the moment coming from traders holding their cash at a loss.

Bitcoin Change Influx Quantity Is Tending In direction of Losses Proper Now

In accordance with information from the on-chain analytics agency Glassnode, the short-term holders are largely contributing to those loss inflows. The “exchange inflow” is an indicator that measures the whole quantity of Bitcoin that’s at the moment flowing into the wallets of centralized exchanges.

Typically, traders deposit to those platforms at any time when wish to promote, so a considerable amount of inflows could be a signal {that a} selloff is happening within the BTC market proper now. Low values of the metric, however, indicate holders might not be collaborating in a lot promoting for the time being, which will be bullish for the value.

Within the context of the present dialogue, the change influx itself isn’t of relevance; a associated metric referred to as the “change influx quantity revenue/loss bias” is. As this indicator’s title already suggests, it tells us whether or not the inflows going to exchanges are coming from revenue or loss holders at the moment.

When this metric has a price higher than 1, it means nearly all of the influx quantity incorporates cash that their holders had been carrying at a revenue. Equally, values beneath the brink indicate a dominance of the loss quantity.

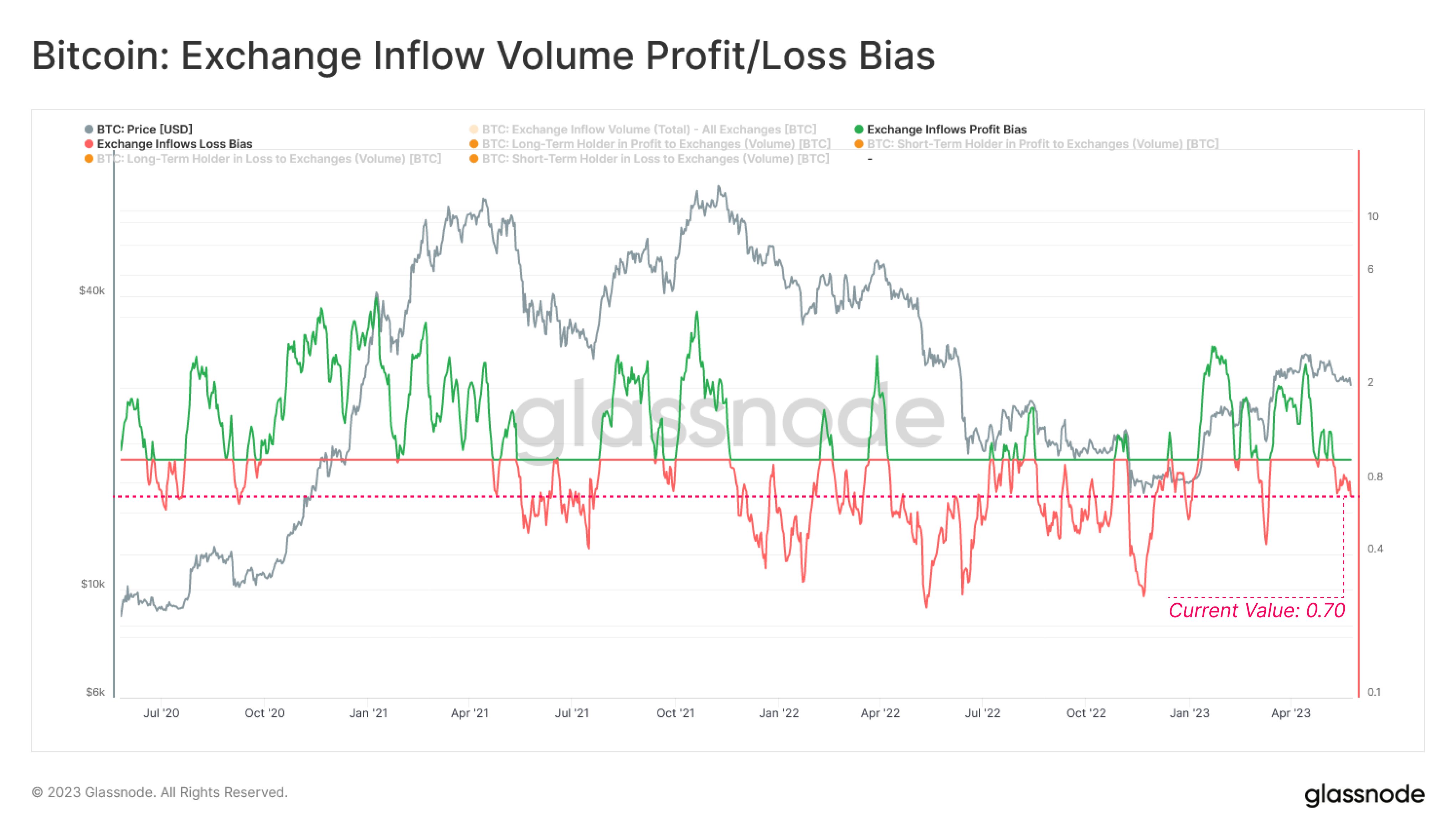

Now, here’s a chart that exhibits the development within the Bitcoin change influx revenue/loss bias over the previous couple of years:

The worth of the metric appears to have noticed some decline in latest days | Supply: Glassnode on Twitter

As proven within the above graph, the Bitcoin change influx quantity revenue/loss bias has had a price above 1 for a lot of the ongoing rallies that began again in January of this yr.

This means that a lot of the change inflows on this interval have come from the revenue holders. This naturally is sensible, as any rally usually entices a lot of holders to promote and harvest their good points.

There have been a few distinctive situations, nevertheless. The primary was again in March when the asset’s worth plunged beneath the $20,000 stage. The bias out there shifted in direction of loss promoting then, implying that some traders who purchased across the native prime had began capitulating.

The same sample has additionally occurred just lately, because the cryptocurrency’s worth has stumbled beneath the $27,000 stage. Following this plunge, the indicator’s worth has come down to simply 0.70.

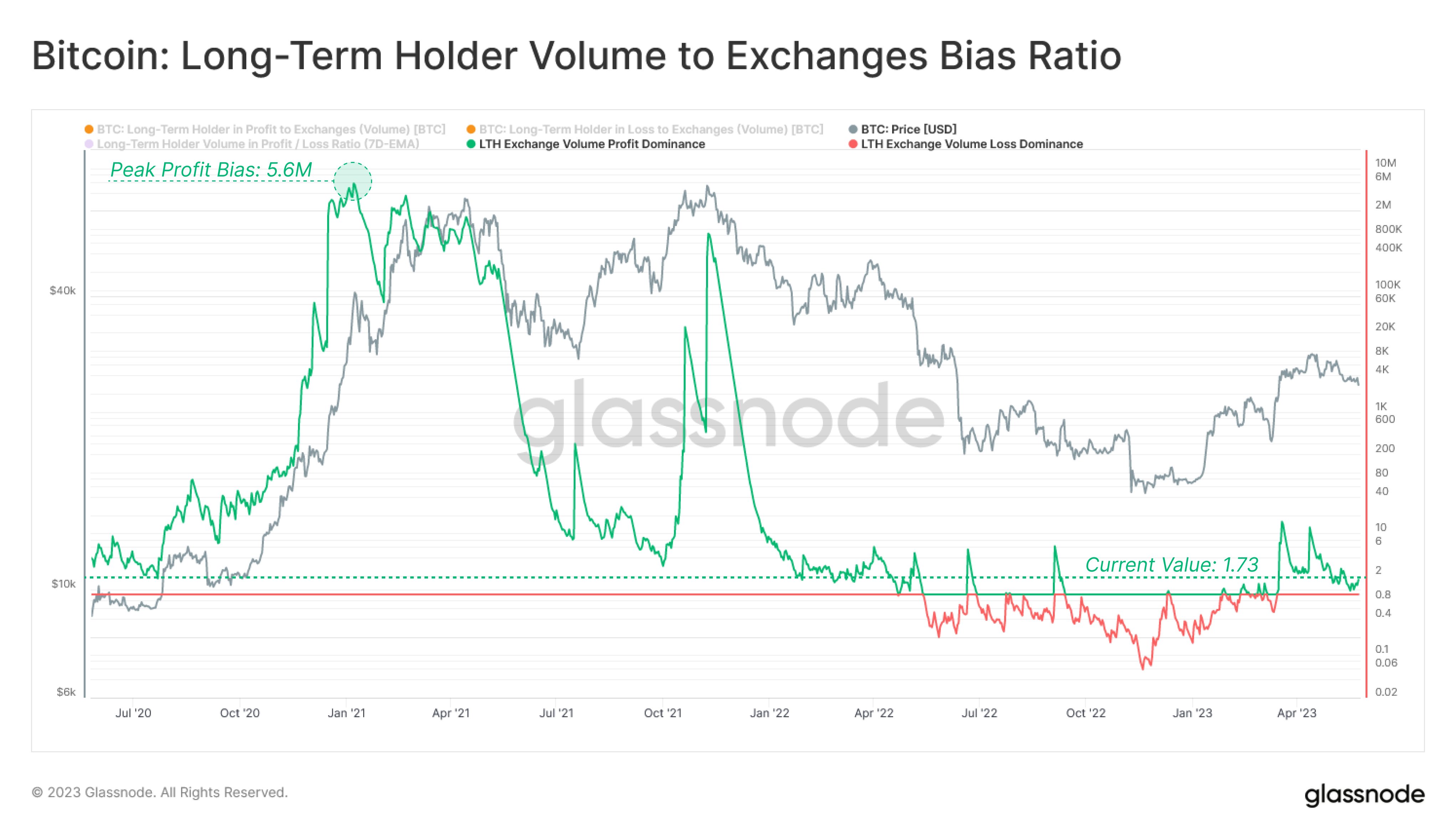

Additional information from Glassnode reveals that the bias of the long-term holders (LTHs), the traders holding their cash since not less than 155 days in the past, have really leaned in direction of income just lately.

Appears just like the indicator has a optimistic worth proper now | Supply: Glassnode on Twitter

From the chart, it’s seen that the indicator has a price of 1.73 for the LTHs, implying a powerful bias towards income. Naturally, if the LTHs haven’t been promoting at a loss, the other cohort should be the short-term holders (STHs).

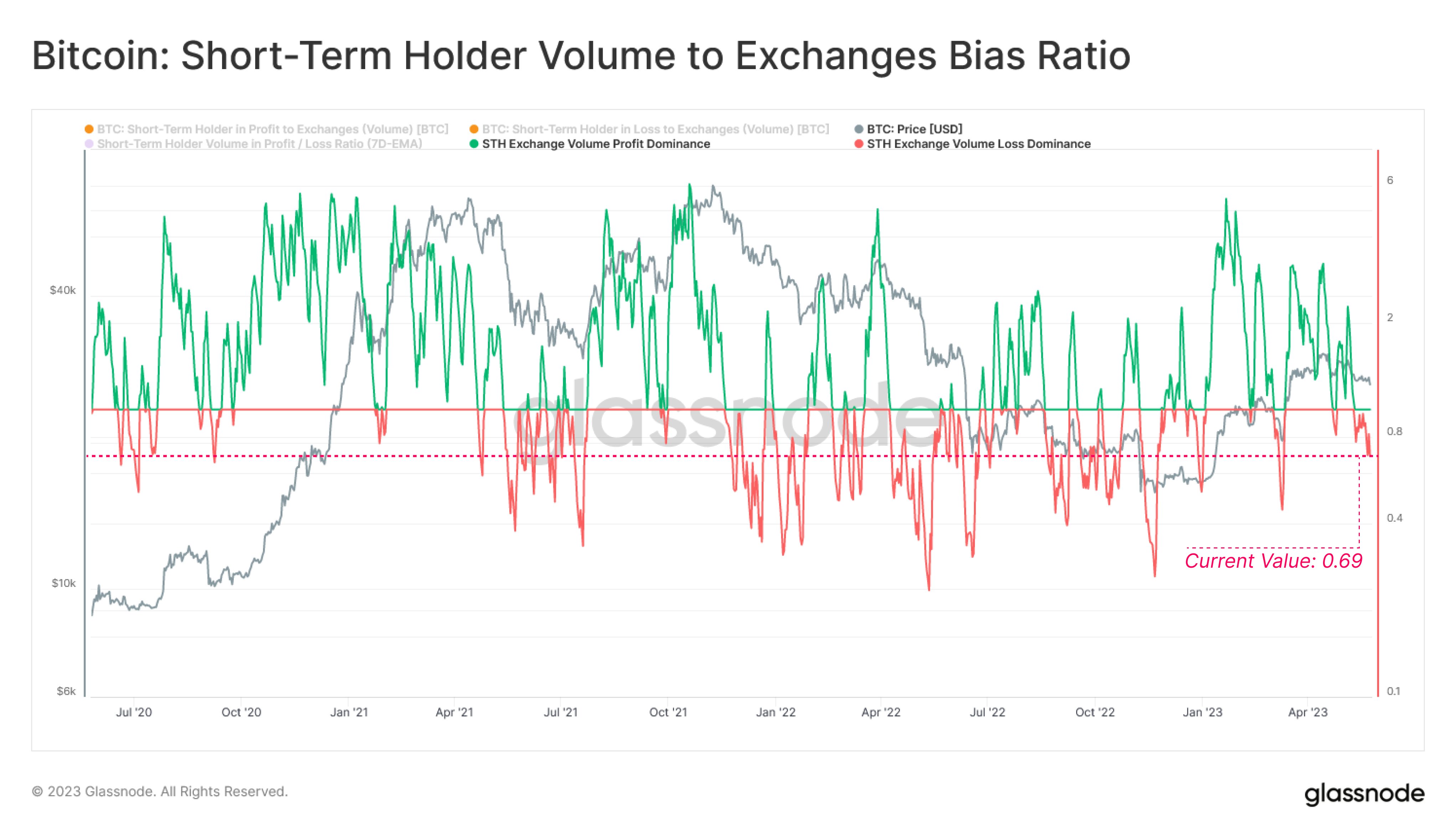

This group appears to have a heavy loss bias at the moment | Supply: Glassnode on Twitter

Apparently, the indicator’s worth for the STHs is 0.69, which is nearly precisely the identical as the typical for your complete market. This might imply that the LTHs have contributed comparatively little to promoting stress just lately.

The STHs promoting proper now can be those that purchased at and close to the highest of the rally to this point and their capitulation could also be an indication that these weak fingers are at the moment being cleansed from the market.

Though the indicator hasn’t dipped as little as in March but, this capitulation may very well be an indication {that a} native backside could also be close to for Bitcoin.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $26,400, down 1% within the final week.

BTC has struggled just lately | Supply: BTCUSD on TradingView

Featured picture from 愚木混株 cdd20 on Unsplash.com, charts from TradingView.com, Glassnode.com

[ad_2]

Source link