[ad_1]

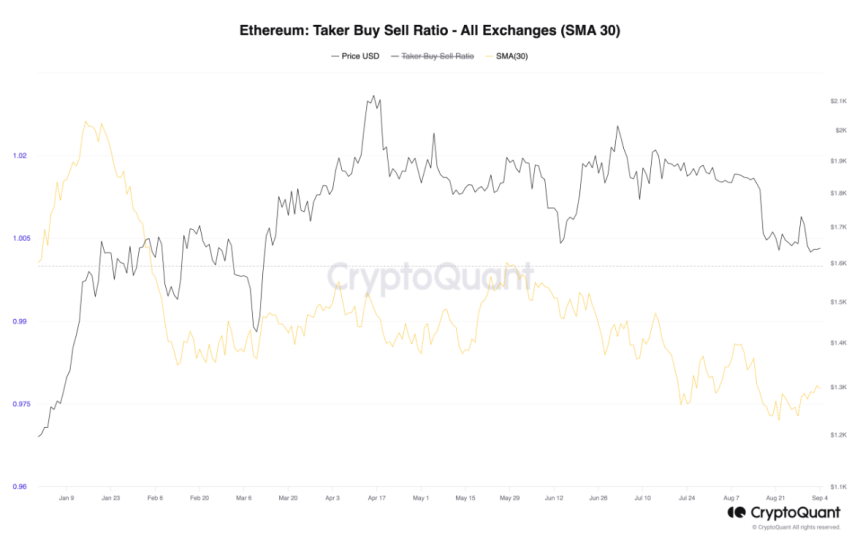

The Ethereum (ETH) market has been gripped by escalating bearish sentiment because the taker buy-sell ratio, a essential indicator of market dynamics, plunged to a yearly low. This downward trajectory has sparked issues amongst buyers and merchants, highlighting the prevailing pessimism within the Ethereum futures market.

ETH’s taker buy-sell ratio, as revealed by a latest report from the nameless CryptoQuant analyst Greatest_Trader, has been on a constant decline over the previous few months. The ratio reached its nadir on the finish of the earlier month, signaling a rising dominance of bears in Ethereum’s buying and selling enviornment.

Greatest_Trader mentioned:

“This constant conduct underscores the dominant bearish sentiment amongst futures merchants collaborating in Ethereum’s market.”

The dwindling taker buy-sell ratio is indicative of elevated promote orders, reflecting a insecurity within the coin’s short-term prospects.

Supply: CryptoQuant

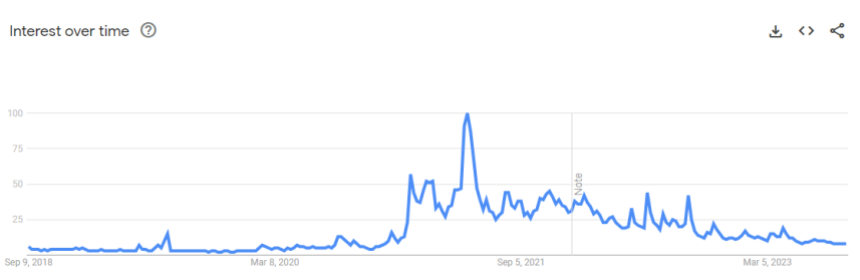

Google Traits Mirror A Loss Of Curiosity In Ethereum

Including to Ethereum’s woes is the declining curiosity of mainstream web customers. Google Trends data signifies that the variety of searches for Ethereum (ETH) has plummeted to ranges not witnessed since November 2020. Much more strikingly, searches for “DeFi” have dipped to four-year lows.

Supply: Google Trends

Within the final seven days, the metric for “Ethereum” plummeted to a dismal 8/100, a stage final seen through the crypto euphoria of 2021, the place web customers had been trying to find Ethereum 12 occasions extra often. This decline in curiosity alerts a major lack of confidence in Ethereum’s prospects amongst retail buyers.

ETH Futures Open Curiosity Hits Yearly Low

The pessimism surrounding Ethereum is additional underscored by an examination of its futures open curiosity. At the moment standing at $4.67 billion, ETH’s open curiosity has reached its lowest level this 12 months, marking a 36% decline since its peak on April 19.

This drop in open curiosity reveals that institutional and retail merchants are more and more skeptical concerning the cryptocurrency’s short-term potential. As of now, Ethereum’s value hovers at $1,622.75, with a 0.6% decline within the final 24 hours and a 1.9% loss over the previous seven days, based on CoinGecko.

Ethereum (ETH) is at present buying and selling at $1,620. Chart: TradingView.com

Ethereum’s once-promising outlook is dealing with headwinds as bearish sentiment prevails in its futures market. The declining taker buy-sell ratio, coupled with a scarcity of curiosity from retail customers, paints a somber image for the cryptocurrency. Furthermore, the dwindling open curiosity in Ethereum’s futures means that merchants are hedging their bets amid rising uncertainty.

Ethereum’s journey within the coming months will undoubtedly be a difficult one, and buyers and fanatics alike will likely be keenly watching to see if it could actually climate this storm and regain its bullish momentum.

(This web site’s content material shouldn’t be construed as funding recommendation. Investing entails threat. If you make investments, your capital is topic to threat).

Featured picture from Vauld

[ad_2]

Source link