[ad_1]

Why Are NFTs Dangerous? This urgent query underscores right now’s heated discussions round Non-Fungible Tokens (NFTs). Regardless of the thrill, many traders are left grappling with unsellable NFTs, questioning their worth and safety. This text cuts by way of the noise to look at the vital points and authorized challenges surrounding NFTs.

We navigate the complicated NFT legal guidelines, dissect the explanations behind the unsellable nature of some digital property, and handle the underlying issues fueling the skepticism. With targeted insights, we intention to make clear the darker facets of NFTs to reply the query: are NFTs dangerous?

Why Are NFTs Dangerous?

The query “Why are NFTs dangerous?” resonates within the digital world, notably amongst these cautious concerning the quickly evolving blockchain know-how. NFTs, or Non-Fungible Tokens, have garnered consideration for his or her distinctive capacity to symbolize possession of digital property. Nevertheless, beneath the floor of this revolutionary know-how lies an internet of considerations which have led many to query their total worth and impression.

Understanding NFTs: A Temporary Overview

NFTs are digital tokens that symbolize possession of distinctive objects, utilizing blockchain know-how to certify authenticity and possession. Every NFT stands out as distinct, in contrast to cryptocurrencies similar to Bitcoin or Ethereum, that are fungible and permit for one-to-one exchanges. They will symbolize something digital, similar to artwork, music, and even tweets.

NFTs derive their uniqueness from granting a sense of exclusivity and possession over digital property, which have historically been simply replicated and distributed. By tokenizing these property on a blockchain, NFTs create a digital shortage and a verifiable approach to declare possession.

Nevertheless, the rise of NFTs has not been with out controversy. Their detractors level to a number of key points: technical points questioning the longevity of NFTs, the potential for market manipulation, and the creation of a speculative bubble the place the worth of digital property is extremely unsure. Moreover, the authorized panorama surrounding NFTs remains to be evolving, with questions on copyright and possession rights on the forefront.

Exploring The Principal Query: Why Are NFTs Dangerous?

Whereas NFTs have their advantages, the rising considerations can’t be missed. The principle query, “Why are NFTs dangerous?” stems from a number of vital points related to their use and performance.

Technical Challenges And Longevity Considerations

The attraction of NFTs on blockchains similar to Ethereum is diminished by varied technical challenges, elevating questions on their long-term viability and dependability as digital property. Listed here are some technical causes for “why are NFTs dangerous”:

- Off-Blockchain Asset Storage: Most NFTs, particularly on Ethereum, hyperlink to digital property like photographs saved off the blockchain attributable to Ethereum’s dimension and price constraints. These property are sometimes hosted on platforms like IPFS (InterPlanetary File System), in a roundabout way on the blockchain.

- Exterior URL Vulnerability: The usage of exterior storage like IPFS raises questions concerning the longevity and accessibility of the linked digital property. The potential obsolescence of those platforms poses a threat to the permanence of NFTs.

- Blockchain-Particular Uniqueness: The individuality of an NFT is proscribed to its native blockchain, like Ethereum. The identical asset could be tokenized on completely different blockchains, difficult the notion of uniqueness.

- Duplicate NFT References: NFTs can reference the identical digital asset through HTTP hyperlinks, resulting in a number of NFTs for a single asset throughout the similar blockchain, opposite to their non-fungible nature.

Market Manipulation And Speculative Bubble

The NFT market isn’t just a platform for digital creativity but in addition a hotbed for hypothesis and potential market manipulation, elevating important considerations. Following are some market-related causes for “why are NFTs dangerous”:

- Speculative Investments: NFTs have turn out to be symbols of speculative funding, with costs typically pushed by hype relatively than intrinsic worth. Excessive-profile gross sales, like that of Beeple’s art work, have attracted a wave of traders seeking to capitalize on potential market booms. This hypothesis can inflate costs artificially, making a bubble the place the worth of NFTs is grossly overestimated.

- Threat Of Market Manipulation: The NFT market is susceptible to manipulation attributable to its comparatively unregulated nature and the opacity of transactions. There have been cases the place artists or sellers artificially inflate the worth of an NFT by buying their very own property by way of third events. This tactic creates a misunderstanding of excessive demand and worth, luring unsuspecting patrons into overpaying.

- Influence Of Superstar Endorsements: The involvement of celebrities and influencers in selling NFTs additional fuels the speculative bubble. Their endorsements can result in fast spikes in costs and curiosity, typically and not using a sustainable foundation. Whereas superstar involvement has introduced mainstream consideration to NFTs, it additionally raises questions concerning the real worth and long-term viability of those property.

- Volatility And Unsustainability: Excessive volatility marks the NFT market, that includes important fluctuations in worth. This instability renders NFT investments dangerous, particularly for people not deeply conversant in the digital asset panorama.

Authorized Ambiguity

The burgeoning world of NFTs is mired in authorized ambiguities, making it a posh panorama to navigate for creators, collectors, and traders alike. Under are some authorized causes for “why are NFTs dangerous”:

Unclear Copyright And Possession Rights:

One of many basic authorized challenges with NFTs is the anomaly surrounding copyright and possession rights. Buying an NFT typically grants the client possession of a singular token, however not essentially the copyright of the underlying digital asset. This distinction can result in confusion and disputes over what patrons are literally entitled to once they purchase an NFT.

Various Worldwide Legal guidelines:

The authorized recognition of NFTs varies considerably throughout completely different jurisdictions. Whereas some nations might have particular laws governing digital property, others lack clear tips. This inconsistency presents challenges, notably in instances involving cross-border transactions or disputes.

Good Contract Complexities:

NFTs function on good contracts—self-executing contracts with the phrases of the settlement straight written into code. Nevertheless, the authorized standing of those contracts is just not all the time clear. Points come up when good contracts, that are immutable as soon as deployed, comprise errors or don’t align with authorized requirements. Rectifying these points could be difficult and will require litigation.

Regulatory Uncertainty:

The regulatory panorama for NFTs remains to be in its infancy. Monetary regulators in varied nations are grappling with how you can classify NFTs—whether or not as securities, commodities, or a very new asset class. This lack of regulatory readability provides to the uncertainty, notably concerning compliance with current monetary legal guidelines and anti-money laundering (AML) necessities.

Legal responsibility And Shopper Safety:

The decentralized nature of NFT marketplaces typically leaves shoppers with restricted recourse in instances of fraud, theft, or disputes. In such eventualities, the problem of legal responsibility stays principally unresolved, and shopper safety mechanisms will not be as sturdy as these in conventional monetary markets.

NFT Execs And Cons

The world of Non-Fungible Tokens (NFTs) presents a combined bag of benefits and downsides. Understanding these professionals and cons is important for anybody seeking to have interaction with NFTs, whether or not as creators, collectors, or traders.

Execs Of NFTs:

- Digital Possession And Provenance: NFTs present a transparent proof of possession and provenance for digital property. They allow artists and creators to monetize digital works, which have been beforehand simple to copy and tough to promote as distinctive items.

- Market Enlargement For Artists: NFTs have opened up new markets for digital artists and creators, permitting them to succeed in a worldwide viewers. This democratization of artwork gross sales has empowered artists, particularly these outdoors the normal gallery system.

- Innovation And Creativity: The NFT house encourages innovation and creativity, notably in digital artwork and multimedia. It has sparked new types of creative expression and collaboration.

- Collectibility And Funding: For collectors, NFTs supply a brand new avenue for funding in digital artwork and collectibles. The distinctive nature of NFTs makes them interesting as collectible objects.

Cons Of NFTs:

- Technical Points: On blockchains like Ethereum, NFTs current a number of technical points, questioning their longevity. Being conscious of those points is essential.

- Market Volatility And Hypothesis: The NFT market is extremely risky, with values fluctuating dramatically. This instability, coupled with speculative investments, poses dangers for patrons and sellers.

- Mental Property Points: The authorized ambiguity round copyright and possession rights in NFTs creates problems for mental property regulation. Consumers may not totally perceive what rights they’re buying, resulting in potential authorized disputes.

- Accessibility And Inclusivity Points: Regardless of their potential for democratizing artwork, NFTs additionally pose challenges when it comes to accessibility and inclusivity. The technical and monetary obstacles to entry could be excessive, limiting participation to a extra tech-savvy and financially succesful viewers.

The Darkish Aspect: Unsellable NFTs And Market Dangers

The world of NFTs isn’t just about innovation and profitable alternatives. There’s a darker facet to this market, characterised by the phenomenon of unsellable NFTs and important market dangers that increase vital questions concerning the total security and soundness of investing in these digital property. This provides one other layer to the query “why are NFTs dangerous.”

The Actuality Of Unsellable NFTs

Whereas NFTs have been offered for staggering quantities, the truth is that not all NFTs discover patrons, resulting in a rising concern over unsellable NFTs. A number of elements contribute to this case:

- Market Saturation: As extra creators and traders flood into the NFT house, the market is changing into more and more saturated. This saturation makes it more durable for particular person NFTs to face out, lowering their chance of being offered.

- Speculative Nature: Many NFTs are purchased for speculative functions, with the hope of reselling for a revenue. When the hypothesis bubble bursts, or if the hype dies down, the worth of those NFTs can plummet, making them tough to promote.

- Lack Of Intrinsic Worth: Some NFTs might lack intrinsic creative or collectible worth, being created solely for the aim of capitalizing on the pattern. These NFTs might wrestle to discover a market.

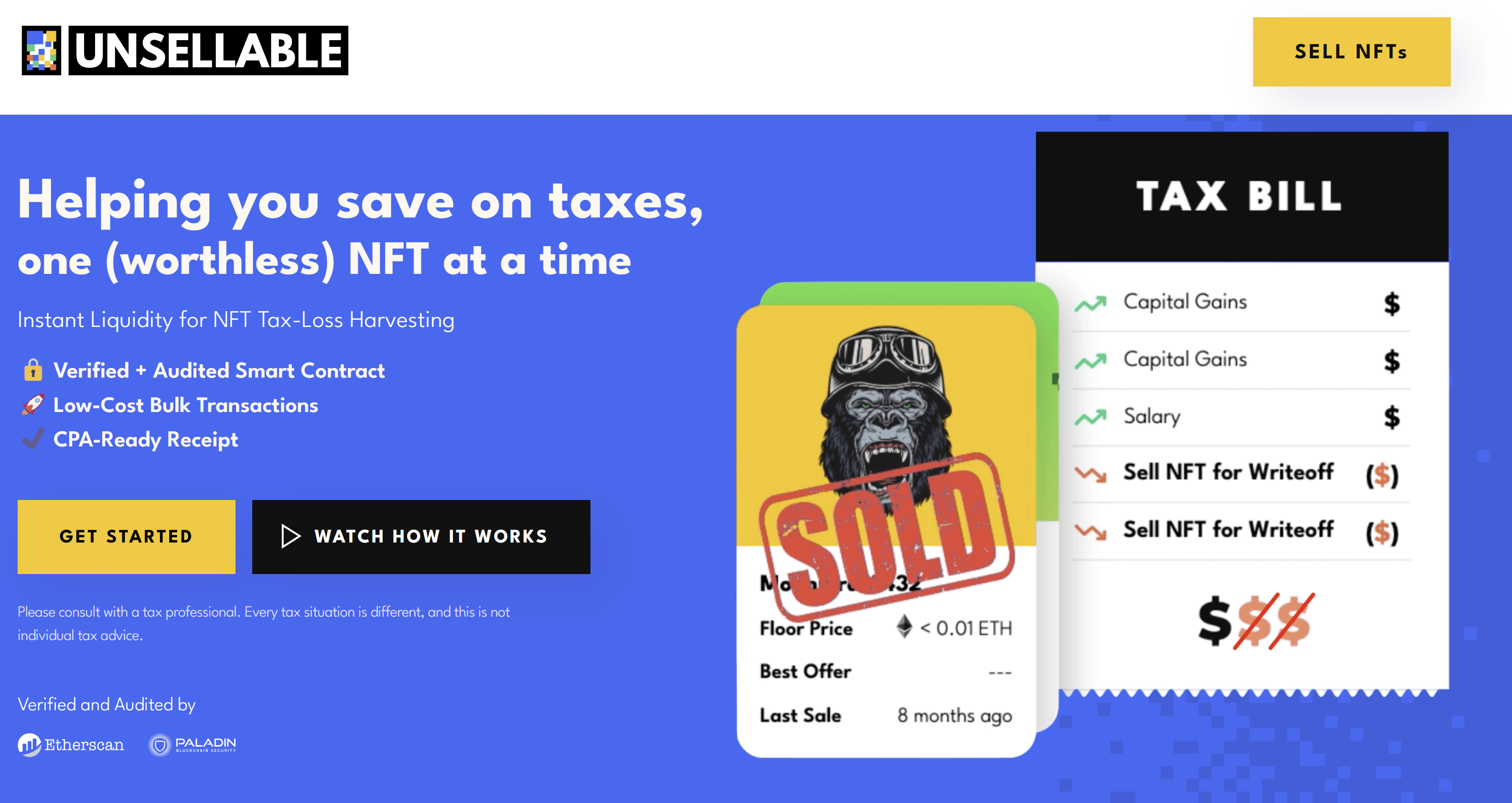

- Liquidity Points: The NFT market is just not as liquid as different funding markets. Promoting an NFT, particularly at a desired worth level, could be difficult and time-consuming.

Platforms like Unsellable concentrate on buying these low-value NFTs for tax write-off functions.

Are NFTs Dangerous?

The query “Are NFTs dangerous?” is complicated. NFTs themselves are a impartial know-how with potential for constructive use, similar to supporting artists and creating distinctive digital experiences. Nevertheless, the problems of market saturation, speculative bubbles, and technical considerations add a destructive facet to this know-how. The reply largely relies on how NFTs are used and the notice of the patrons and sellers concerning the dangers concerned.

Are NFTs Protected?

The protection of investing in NFTs is a matter of perspective and relies on varied elements:

- Technical Points: NFTs on Ethereum face a number of issues that traders ought to concentrate on.

- Market Volatility: The excessive volatility of the NFT market can result in important monetary dangers for traders.

- Authorized and Technical Dangers: As mentioned earlier, there are authorized ambiguities and technical challenges related to NFTs, which may impression their long-term viability.

- Scams And Fraud: The NFT house, like all rising market, is inclined to NFT scams and fraudulent actions, which may pose dangers to much less skilled traders.

NFT Legal guidelines: Authorized Challenges

Navigating the complicated authorized panorama of NFTs poses a problem, provided that these digital property intersect varied facets of regulation in methods which are nonetheless evolving and being outlined. The dynamic and quickly evolving nature of NFTs has left lawmakers and stakeholders working to meet up with the authorized implications which provides one other argument to the query “why are NFTs dangerous”.

NFT Legal guidelines Decoded

The appliance of current legal guidelines to NFTs is a difficult process, primarily as a result of NFTs are a novel idea that doesn’t match neatly into conventional authorized classes. Mental property rights are on the forefront of authorized considerations. When somebody purchases an NFT, they purchase a token that represents possession, however the extent of this possession is usually misunderstood. It hardly ever contains the fitting to breed or distribute the underlying digital asset, resulting in potential authorized disputes over copyright infringement and possession rights.

Shopper safety legal guidelines are additionally vital within the NFT market. These legal guidelines are designed to guard patrons from misleading practices. Nevertheless, the decentralized and infrequently nameless nature of blockchain transactions makes the enforcement of such legal guidelines difficult. The chance of fraud and misrepresentation is excessive, and patrons might discover themselves with restricted recourse in instances of dispute.

The classification of NFTs beneath monetary laws is one other space of authorized ambiguity. The construction and nature of sure NFTs may classify them as securities. For instance, the US Securities and Trade Fee charged Stoner Cats 2 for conducting an “unregistered providing of crypto asset securities,” relying on their particular traits. This categorization topics them to stringent regulatory necessities, together with registration and disclosure obligations beneath securities legal guidelines. Nevertheless, the shortage of clear steerage from regulatory our bodies creates uncertainty for NFT issuers and traders.

NFT Authorized Points: A Detailed Evaluation

Authorized points within the NFT house are numerous and multifaceted. Copyright and possession disputes are frequent, notably because the traces between digital possession and copyright possession are blurred. These disputes typically contain a number of events, together with artists, digital platforms, and collectors, every with differing interpretations of their authorized rights.

Good contracts, that are the spine of NFT transactions, current their very own set of authorized challenges. Whereas these contracts are designed to be self-executing and immutable, they aren’t proof against authorized scrutiny. Disputes can come up when the phrases encoded in good contracts battle with statutory legal guidelines or when there are errors within the code. The decision of such disputes typically requires litigation, which could be complicated and dear.

Taxation of NFT transactions is an rising space of authorized concern. The tax implications for purchasing, promoting, or creating NFTs will not be easy, and tax authorities are nonetheless figuring out how you can apply current tax legal guidelines to those transactions. This uncertainty complicates monetary planning for contributors within the NFT market and raises the danger of unintended tax liabilities.

The Evolving Panorama Of NFT Legality

Because the NFT market continues to develop, so does the authorized framework that surrounds it. Governments and regulatory our bodies worldwide are starting to acknowledge the necessity for particular laws that handle the distinctive facets of NFTs. These rising laws intention to supply readability and stability to the market, however in addition they deliver new compliance challenges.

The worldwide nature of NFT transactions provides one other layer of complexity. NFTs are sometimes purchased and offered throughout worldwide borders, bringing into play completely different authorized jurisdictions and regulatory requirements. Harmonizing these numerous authorized programs is a frightening process and one that’s vital for the event of a cohesive world NFT market.

Authorized instances involving NFTs are more and more making their manner by way of courts, setting vital precedents that can affect future authorized interpretations and laws. These instances cowl a variety of points, from copyright disputes to the enforceability of good contracts, and their outcomes could have important implications for the NFT business.

In conclusion, the authorized challenges surrounding NFTs are as dynamic and multifaceted because the know-how itself. From mental property considerations to regulatory compliance, the authorized facets of NFTs require cautious navigation. Because the market evolves, so too will the legal guidelines and laws that govern it, shaping the way forward for this revolutionary digital asset class.

The Downside With NFTs

The world of Non-Fungible Tokens (NFTs) is marked not solely by innovation and alternative but in addition by important issues that increase considerations and contribute to the query, “Why are NFTs dangerous?”.

Analyzing Extra Of The Downside With NFTs

A more in-depth look reveals a number of underlying issues with NFTs:

- Perceived Worth Vs. Actual Worth: A core downside with NFTs is the disconnect between their perceived and actual worth. The price of many NFTs is usually pushed by hype and hypothesis relatively than tangible creative or utilitarian worth. This discrepancy can result in a risky market the place costs don’t mirror the true worth of the underlying digital asset.

- Cultural And Moral Considerations: The NFT craze has raised cultural and moral questions. It challenges conventional notions of artwork possession and creation, probably commodifying creative expression in unprecedented methods.

- Influence On Creative Integrity: For artists, the lure of NFTs can generally result in a compromise in creative integrity. The stress to create content material that’s extra prone to promote within the NFT market can affect creative choices, probably resulting in a homogenization of digital artwork.

- Accessibility And Digital Divide: The NFT ecosystem tends to favor these with entry to particular technological assets and information. This digital divide excludes a big section of potential creators and collectors, notably these from underprivileged backgrounds or areas with restricted entry to superior know-how.

Blockchain Authorized Points

Earlier discussions have addressed the authorized challenges of blockchain, the underlying know-how of NFTs, however additional exploration reveals further nuances price contemplating:

- Information Privateness Considerations: Blockchain’s transparency and immutability, whereas strengths, additionally increase knowledge privateness considerations. As soon as on the blockchain, info turns into virtually inconceivable to take away, probably resulting in privateness points, particularly with private knowledge concerned.

- Good Contract Liabilities: Good contracts are liable to coding errors or unexpected authorized implications. These liabilities can result in complicated authorized eventualities the place the tasks and liabilities of events in a blockchain transaction are unclear or disputed.

- Cross-Border Enforcement: Imposing authorized choices throughout borders is a big problem in blockchain transactions. When a dispute arises, the worldwide and decentralized nature of blockchain makes it tough to implement judgments or authorized actions.

- Rising Authorized Frameworks: As governments and regulatory our bodies begin to meet up with blockchain know-how, new authorized frameworks are rising. These frameworks intention to handle the distinctive challenges posed by blockchain but in addition create a shifting authorized panorama that may be tough for contributors to navigate.

In conclusion, the issues with NFTs prolong past easy technical or market points, encompassing broader cultural, moral, and authorized challenges. Because the NFT house matures, addressing these multifaceted issues will likely be essential for its sustainable and accountable progress.

FAQ: Why Are NFTs Dangerous?

This FAQ part goals to succinctly handle some key questions surrounding NFTs, particularly every little thing concerning the questions “why are NFTs dangerous?”

Why Are NFTs Dangerous?

Critics typically goal NFTs for his or her environmental impression, market volatility, and authorized uncertainties. Considerations additionally embrace the potential for exacerbating the digital divide. The angle on whether or not NFTs are “dangerous” varies primarily based on particular person viewpoints and contexts.

NFT Legal guidelines: What Buyers Ought to Know?

Buyers ought to word that the authorized framework round NFTs is evolving. Key issues embrace copyright and monetary laws, in addition to the market’s inherent volatility and potential authorized dangers.

Are NFTs Unsellable?

Not all NFTs are unsellable, however market saturation and fluctuating values can have an effect on their salability. The speculative nature of the market provides to the uncertainty concerning the sale and worth of NFTs.

Are NFTs Dangerous?

Whether or not NFTs are “dangerous” is subjective. Whereas they provide revolutionary digital asset possession, their environmental prices, potential for market manipulation, and authorized challenges are important drawbacks.

What Is The Downside With NFTs?

The principle points with NFTs embrace environmental considerations, market instability, accessibility challenges, and authorized ambiguities, highlighting the necessity for sustainable practices and clear laws.

What’s The Downside With NFTs?

NFTs face environmental, financial, authorized, and moral challenges, together with power consumption, market fluctuation, and impacts on creative and cultural values.

Are NFTs Authorized?

NFTs are authorized, however they function in a posh regulatory panorama that varies throughout areas. The legality entails issues round transactional frameworks and compliance with current legal guidelines.

Featured picture from Shutterstock

[ad_2]

Source link